2008 G20 Washington summit

It achieved general agreement amongst the G20 on how to cooperate in key areas so as to strengthen economic growth, deal with the 2008 financial crisis, and lay the foundation for reform to avoid similar crises in the future.

"[5] The notion of a "revived Bretton Woods system" was introduced in a 2004 paper by Dooley, Folkerts-Landau, and Garber, in which it is described as arising after the end of the Cold War, out of the choice of countries, "mainly in Asia, [which] chose the same periphery strategy as immediate post-war Europe and Japan, undervaluing the exchange rate, managing sizable foreign exchange interventions, imposing controls, accumulating reserves, and encouraging export-led growth by sending goods to the competitive center countries.

[6] In 2005, Roubini and Setser opined that: "If the US does not take policy steps to reduce its need for external financing before it exhausts the world's central banks willingness to keep adding to their dollar reserves – and if the rest of the world does not take steps to reduce its dependence on an unsustainable expansion in US domestic demand to support its own growth – the risk of a hard landing for the US and global economy will grow.... a sharp fall in the value of the US dollar, a rapid increase in US long-term interest rates and a sharp fall in the price of a range of risk assets including equities and housing.

"[9] However, Brown's approach was quite different than the original Bretton Woods system, emphasising the continuation of globalization and free trade as opposed to a return to fixed exchange rates.

[12][13][14] On 20 October 2008, Tremonti told the Italian daily Corriere della Sera that proposals for a new Bretton Woods had been spread for many years by American political activist Lyndon LaRouche.

German Chancellor Angela Merkel and French President Nicolas Sarkozy said "Bretton Woods II" should bring about "genuine, all-encompassing reform of the international financial system".

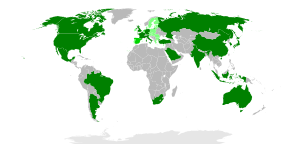

The five key objectives the leaders agreed upon were: A summary of the meeting's other salient points is presented by the White House in the "Fact Sheet"[26] while the full conclusions are given in the Summit Declaration.

[28] The 2009 G20 management troika (U.K., Brazil, South Korea) is charged with coordinating the task of coming up with the content and method of implementing the 47 short and mid-term objectives by March 2009.

[45] The Hindu's Business Line opined that "it is all very well to speak blithely of new Bretton Woods institutions but, when there is no acceptance of a world mediated by Western ideas, the move is doomed ab initio.

"[46] The UN General Assembly set up an Interactive Panel on the Global Financial Crisis which held its first meeting in New York on 30 October 2008, led by Professor Joseph Stiglitz.