2010s oil glut

They include general oversupply as unconventional US and Canadian tight oil (shale oil) production reached critical volumes, geopolitical rivalries among oil-producing nations, falling demand across commodities markets due to the deceleration of the Chinese economy, and possible restraint of long-term demand as environmental policy promotes fuel efficiency and steers an increasing share of energy consumption away from fossil fuels.

The world price of oil was above US$125 per barrel ($790/m3) in 2012, and remained relatively strong above $100 until September 2014, after which it entered a sharp downward spiral, falling below $30 by January 2016.

OPEC production was poised to rise further with the lifting of international sanctions against Iran, at a time when markets already appeared to be oversupplied by at least 2 million barrels (320,000 m3) per day.

On 6 April 2014, the economist Nicolas J. Firzli, writing in a Saudi Arabian journal World Pensions Forum, warned that the escalating oversupply could have durably negative economic consequences for all Gulf Cooperation Council member states.

"...the price of oil has stabilized at a relatively high level (around $100 a barrel) unlike all previous recessionary cycles since 1980 (start of First Persian Gulf War).

Firzli wrote, "What we're witnessing here is a fight to the death between the world's leading oil and natural gas producers at a time when fossil fuel prices are collapsing across the board.

"[13] The environmental impacts of fossil fuels, especially oil, led to government policies promoting the use of zero-carbon energy sources to prevent or slow climate change.

Future action on such environmental concerns, ranging from climate change to smog, has severely hurt the notion that oil demand would forever rise.

[citation needed] Immediately after the death of Hugo Chávez, President Raul Castro sought a new benefactor as the oil that was shipped from Venezuela to Cuba began to slow.

Many OPEC members, such as Venezuela, Algeria, Libya, Iraq, Ecuador and Nigeria, have had internal crises spawned or worsened by the collapse in oil revenues.

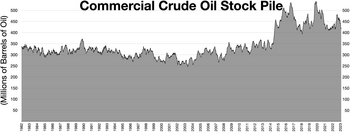

Large build in stock in late 2014