Accounting ethics

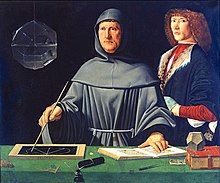

Accounting was introduced by Luca Pacioli, and later expanded by government groups, professional organizations, and independent companies.

[4] They rely on the opinion of the accountants who prepared the statements, as well as the auditors that verified it, to present a true and fair view of the company.

These various groups have led accountants to follow several codes of ethics to perform their duties in a professional work environment.

[12] The AAPA was renamed several times throughout its history, before becoming the American Institute of Certified Public Accountants (AICPA) as it is named today.

[15] In 1993, the first United States center that focused on the study of ethics in the accounting profession opened at Binghamton University.

Supporters point out that ethics are important to the profession, and should be taught to accountants entering the field.

[18] In addition, the education would help to reinforce students' ethical values and inspire them to prevent others from making unethical decisions.

[20] The Accounting Education Change Commission (AECC) has called for students to "know and understand the ethics of the profession and be able to make value-based judgments.

[24] This thought process along with other criticisms of the profession's issues with conflict of interest, have led to various increased standards of professionalism while stressing ethics in the work environment.

Accountants serve as financial reporters and intermediaries in the capital markets and owe their primary obligation to the public interest.

Accordingly, ethical improprieties by accountants can be detrimental to society, resulting in distrust by the public and disruption of efficient capital market operations.

Various companies had issues with fraudulent accounting practices, including Nugan Hand Bank, Phar-Mor, WorldCom, and AIG.

One of the most widely reported violation of accounting ethics involved Enron, a multinational company, that for several years had not shown a true or fair view of their financial statements.

[27] Although only a fraction of Arthur Anderson's employees were involved with the scandal, the closure of the firm resulted in the loss of 85,000 jobs.

Several studies have proposed that a firm's corporate culture as well as the values it stresses may negatively alter an accountant's behavior.

This focus allowed for occurrences of fraud, and caused the firms, according to Arthur Bowman, "... to offer services that made them more consultants and business advisers than auditors.

"[32] As accounting firms became less interested in the lower-paying audits due to more focus on higher earning services such as consulting, problems arose.

"When people need a doctor, or a lawyer, or a certified public accountant, they seek someone whom they can trust to do a good job — not for himself, but for them.

According to recent studies, many believe that the principles-based approach in financial reporting would not only improve but would also support an auditor upon dealing with client's pressure.

However, as a new chairperson of the SEC takes over the system, the transition brings a stronger review about the pros and cons of rules- based accounting.

These results offers insight to the SEC, IASB and FASB in weighing the arguments in the debate of principles- vs. rules based- accounting.

In August 2008, the Securities and Exchange Commission (SEC) proposed that the United States switch from GAAP to IFRS, starting in 2014.

[36] Since the major accounting scandals, new reforms, regulations, and calls for increased higher education have been introduced to combat the dangers of unethical behavior.

The report also recommended that companies pursue options that would improve training and support so accountants could better handle ethical dilemmas.

The highlights of the legislation are consumer protections with authority and independence, ends too big to fail bail outs, advance warning system, transparency and accountability for exotic instruments, executive compensation and corporate governance, protects investors, and enforces regulations on the books.

Congress authorized the SEC to provide monetary awards to whistleblowers who come forward with information that results in a minimum of a $1,000,000 sanction.