Emigration from the United States

[1] Residence in countries outside the British Empire was unusual, and usually limited to the wealthy, such as Benjamin Franklin, who was able to self-finance his trip to Paris as a U.S. diplomat.

During the early 19th century, particularly between 1824 and 1826, thousands of free blacks emigrated from the United States to Haiti to escape antebellum segregation and racist policy.

However, 453 African workers were sent to Ile-à-Vache in Haiti as part of a private colonization effort run by entrepreneur Bernard Kock.

They founded their capital, Carlota, and had planned to make more settlements, but the colony was abandoned after the fall of the Second Mexican Empire, and most of the settlers returned to the U.S.

[5] In the period between the First and Second World Wars, many Americans, particularly writers such as Ernest Hemingway, Gertrude Stein, and Ezra Pound, migrated to Europe to take part in the cultural scene.

European cities like Amsterdam, Berlin, Copenhagen, Paris, Prague, Rome, Stockholm, and Vienna came to host a large number of Americans.

Many Americans, typically those who were idealistic and/or involved in left-leaning politics, also participated in the Spanish Civil War (mainly supporting the Republicans against the Nationalists) in Spain while they lived in Madrid and elsewhere.

[7] European nations, including neutral states like Denmark, Norway, Sweden, and Switzerland, offered asylum to thousands of American expatriates who refused to fight.

During this period Americans continued to travel abroad for religious reasons, such as Richard James, inventor of the Slinky, who went to Bolivia with the Wycliffe Bible Translators, and the Peoples Temple establishment of Jonestown in Guyana.

Additionally, with the global dominance of the United States in the world economy, the ESL industry continued to grow, especially in new and emerging markets.

Iraq War deserters sought refuge mostly in Canada and Europe, and NSA whistleblower Edward Snowden escaped to Russia.

[13] A survey by Arton Capital found that 53 percent of American millionaires are more likely to leave the country after the 2024 presidential election, regardless of who wins.

[19] Some Americans may also emigrate to evade legal liabilities; a common past case was evasion of mandatory military service.

In addition to Americans who choose to emigrate as adults, many children are born in the United States to foreign temporary workers or international students and naturally move with their parents when they return to their countries of origin.

In addition to U.S. territories, U.S. citizens have the right to reside in the Marshall Islands, Micronesia and Palau due to a Compact of Free Association between the United States and each of these countries.

Americans with parents or ancestors from certain countries, such as Germany, Ireland and Italy, may be able to claim nationality via jus sanguinis and therefore move there freely.

Germany and Austria also have an easier path to citizenship for descendants of victims of Nazi crimes, even if jus sanguinis does not apply in the specific case.

[26] Given the high dynamics of the emigration-prone groups, emigration from the United States remains indiscernible from temporary country leave.

[32] The most prominent piece of legislation which has attracted the ire of Americans abroad is the Foreign Account Tax Compliance Act (FATCA).

Disadvantages stemming from FATCA, such as hindering career advancement overseas, may decrease the number of Americans in the diaspora in future years.

The United States Census Bureau does not count Americans abroad, and individual U.S. embassies offer only rough estimates.

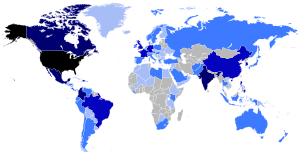

[29][37] In 2016, the agency estimated 9 million U.S. citizens were living abroad,[38] but these numbers are highly open to dispute as they often are unverified and can change rapidly.

[44] This number is mostly based on country of birth recorded in censuses, so it does not include U.S. citizens who were not born in the United States, such as those who acquired U.S. citizenship by descent or naturalization.

[45] Sizes of certain subsets of U.S. citizens living abroad can be estimated based on statistics published by the Internal Revenue Service (IRS).

During 2019, the IRS recorded about 739,000 U.S. tax returns filed with a foreign address, representing about 1.3 million people including spouses and dependents.