Economy of Argentina

[26] Before the 1880s, Argentina was a relatively isolated backwater, dependent on the salted meat, wool, leather, and hide industries for both the more significant part of its foreign exchange and the generation of domestic income and profits.

The Argentine economy began to experience swift growth after 1880 through the export of livestock and grain raw materials, and British and French investment, marking the beginning of a fifty-year era of significant economic expansion and mass European immigration.

According to a study by Baten and Pelger and Twrdek (2009), where the authors compare anthropometric values, i.e., height with real wages, Argentina's GDP increased for the decades after 1870.

[citation needed] The war led to reduced availability of imports and higher prices for Argentine exports that combined to create a US$1.6 billion cumulative surplus, a third of which was blocked as inconvertible deposits in the Bank of England by the Roca–Runciman Treaty.

Benefiting from innovative self-financing and government loans alike, value-added in manufacturing nevertheless surpassed that of agriculture for the first time in 1943, employed over 1 million by 1947, and allowed the need for imported consumer goods to decline from 40% of the total to 10% by 1950.

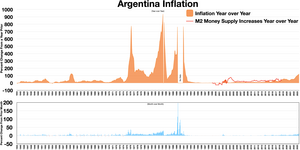

The dictatorship's chief economist, José Alfredo Martínez de Hoz, advanced a controversial, neoliberal policy of financial liberalization that increased the debt burden and failed to curb inflation, which reached 344% in 1983.

[31] While black markets and shortages disappeared as price and exchange controls were removed,[32] the currency devalued tenfold[33] and the economy failed to grow.

[citation needed] Attempting to remedy this situation, economist Domingo Cavallo pegged the peso to the U.S. dollar in 1991 and limited the money supply's growth.

These include the postal service, ASA (the water utility serving Buenos Aires), Pension funds (transferred to ANSES), Aerolíneas Argentinas, the energy firm YPF, and the railways.

Foreign exchange controls, austerity measures, persistent inflation, and downturns in Brazil, Europe, and other important trade partners, contributed to slower growth beginning in 2012, however.

[citation needed] In May 2018, Argentina's government asked the International Monetary Fund for its intervention, with an emergency loan for a $30 billion bailout, as reported by Bloomberg.

[citation needed] To the cause of the quarantine in 2020, in April, 143,000 SMEs will not be able to pay salaries and fixed expenses for the month, even with government assistance, so they will have to borrow or increase their capital contribution, and approximately 35,000 companies consider closing their business.

With this inflation in mind, Javier Milei (Argentina's newly sworn in president as of 10 December 2023, with 55.69% of the vote in the runoff election[35]) weakened the Argentine Peso by 50% to 800 per dollar in order to bring the official exchange rate (which was only used in theory) down to the market exchange range,[36] along with cuts to energy subsidies, cancellations of public works, and more in order to save nearly 20 billion dollars in expenses.

However, challenges still remain, and 69% of Argentinians believe its a bad time to look for a job in this economy, while 35% don't have enough money for food, although these figures are a modest decrease from their 2 decade high in 2019.

[63] Soy and its byproducts, mainly animal feed and vegetable oils, are major export raw materials with one fourth of the total; cereals added another 10%.

[64] Fruits and vegetables made up 4% of exports: apples and pears in the Río Negro valley; rice, oranges and other citrus in the northwest and Mesopotamia; grapes and strawberries in Cuyo (the west), and berries in the far south.

According to the 2019 list, Argentina has the 31st most valuable industry in the world (57.7 billion dollars), behind Mexico, Brazil and Venezuela, but ahead of Colombia, Peru and Chile.

High labour costs for Argentina assembly work tend to limit product sales penetration to Latin America, where regional trade treaties exist.

Nuclear energy is also of high importance,[95] and the country is one of the largest producers and exporters, alongside Canada and Russia of cobalt-60, a radioactive isotope widely used in cancer therapy.

An important number of these projects are being financed by the government through trust funds, while independent private initiative is limited as it has not fully recovered yet from the effects of the Argentine economic crisis.

[125][126] Expressways are, however, currently inadequate to deal with local traffic,[126] as over 12 million motor vehicles were registered nationally as of 2012 (the highest, proportionately, in the region).

[131][132][133] In the years leading up to this move, the country's railways had seen significant investment from the state, purchasing new rolling stock, re-opening lines closed under privatization and re-nationalising companies such as the Belgrano Cargas freight operator.

Under the 1994 U.S.–Argentina Bilateral Investment Treaty, U.S. investors enjoy national treatment in all sectors except shipbuilding, fishing, nuclear-power generation, and uranium production.

[163] FDI volume remained below the regional average as a percent of GDP even as it recovered, however; Kirchner Administration policies and difficulty in enforcing contractual obligations had been blamed for this modest performance.

These disputes had led to a number of liens against central bank accounts in New York and, indirectly, to reduced Argentine access to international credit markets.

[168] The government under President Mauricio Macri announced to be seeking a new loan from the International Monetary Fund in order to avoid another economic crash similar to the one in 2001.

[173] Argentina's unemployment rate similarly declined from 25% in 2002 to an average of around 7% since 2011 largely because of both growing global demand for Argentine raw materials and strong growth in domestic activity.

[184][188] Consumer inflation expectations of 28 to 30% led the national mint to buy banknotes of its highest denomination (100 pesos) from Brazil at the end of 2010 to keep up with demand.

[200][201] On October 12, 2023, Argentina's central bank again increased the benchmark interest rate from 118% to 133% since September's inflation report (12.7% monthly and 138% annually) was worse than forecasted.

taking about the protest [203] After Milei's landslide victory in the presidential elections held on october 2023, large efforts were made to curb the inflation rate, with major successes.

Daily data points [ 183 ]