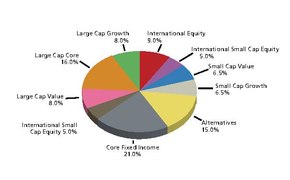

Asset allocation

Many financial experts argue that asset allocation is an important factor in determining returns for an investment portfolio.

When such backward-looking approaches are used to forecast future returns or risks using the traditional mean-variance optimization approach to the asset allocation of modern portfolio theory (MPT), the strategy is, in fact, predicting future risks and returns based on history.

As there is no guarantee that past relationships will continue in the future, this is one of the "weak links" in traditional asset allocation strategies as derived from MPT.

An asset class is a group of economic resources sharing similar characteristics, such as riskiness and return.

In 1986, Gary P. Brinson, L. Randolph Hood, and SEI's Gilbert L. Beebower (BHB) published a study about asset allocation of 91 large pension funds measured from 1974 to 1983.

[11] The conclusion of the study was that replacing active choices with simple asset classes worked just as well as, if not even better than, professional pension managers.

However, in response to a letter to the editor, Hood noted that the returns series were gross of management fees.

[13] In 1997, William Jahnke initiated a debate on this topic, attacking the BHB study in a paper titled "The Asset Allocation Hoax".

[14] The Jahnke discussion appeared in the Journal of Financial Planning as an opinion piece, not a peer reviewed article.

Jahnke's main criticism, still undisputed, was that BHB's use of quarterly data dampens the impact of compounding slight portfolio disparities over time, relative to the benchmark.

[15] Hood, however, rejects this interpretation on the grounds that pension plans, in particular, cannot cross-share risks and that they are explicitly singular entities, rendering shared variance irrelevant.

A 2000 paper by Meir Statman found that using the same parameters that explained BHB's 93.6% variance result, a hypothetical financial advisor with perfect foresight in tactical asset allocation performed 8.1% better per year, yet the strategic asset allocation still explained 89.4% of the variance.

Hood notes in his review of the material over 20 years, however, that explaining performance over time is possible with the BHB approach but was not the focus of the original paper.

The results suggest that real estate, commodities, and high yield add the most value to the traditional asset mix of stocks, bonds, and cash.

[18] Doeswijk, Lam and Swinkels (2014) argue that the portfolio of the average investor contains important information for strategic asset allocation purposes.

[19] Doeswijk, Lam and Swinkels (2019) show that the global market portfolio realizes a compounded real return of 4.45% per year with a standard deviation of 11.2% from 1960 until 2017.

The reward for the average investor over the period 1960 to 2017 is a compounded return of 3.39% points above the risk-less rate earned by savers.