Economy of Australia

The country has also entered into free trade agreements with ASEAN, Canada, Chile, China, South Korea, Malaysia, New Zealand, Peru, Japan, Singapore, Thailand and the United States.

As opposed to many neighbouring Southeast Asian countries, the process towards independence was relatively peaceful and thus did not have significant negative impact on the economy and standard of living.

In 1983, under prime minister Bob Hawke, but mainly driven by treasurer Paul Keating, the Australian dollar was floated and financial deregulation was undertaken.

The early 1990s recession came swiftly after the Black Monday of October 1987, as a result of a stock collapse of unprecedented size which caused the Dow Jones Industrial Average to fall by 22.6%.

As the economy expanded, large-scale immigration satisfied the growing demand for workers, especially after the end of convict transportation to the eastern mainland in 1840.

[101][102] The period since has seen these trends reversed with Western Australia and Northern Territory, who are heavily dependent on mining, experience significant downturns in GDP while the eastern states returned to growth, led by strong upturns in NSW and Victoria.

As a result of state dependence on federal taxation revenue to meet decentralised expenditure responsibilities, Australia is said to have a vertical fiscal imbalance.

Besides receipts of funds from the federal government, states and territories have their own taxes, in many cases as slightly different rates.

The states rejected Canberra's regime and challenged the legislation's validity in the First Uniform Tax Case (South Australia v Commonwealth) of 1942.

The High Court of Australia held that each of the statutes establishing Commonwealth income tax was a valid use of the s. 51(ii) power, in which Latham CJ noted that the system did not undermine essential state functions and imposed only economic and political pressure upon them.

In Ha vs. New South Wales (1997), the High Court found that the Business Franchise Licences (Tobacco) Act 1987 (NSW) was invalid because it levied a customs duty, a power exercisable only by the Commonwealth (s.90).

Consequently, Australia has one of the most pronounced vertical fiscal imbalances in the world: the states and territories collect just 18% of all governmental revenues but are responsible for almost 50% of the spending areas.

Councils also rely on state and federal funding to provide infrastructure and services such as roads, bridges, sporting facilities and buildings, aged care, maternal and child health, and childcare.

[156] IT-related jobs (such as computer systems design and engineering) are defined as Professional, Scientific and Technical Services by the Department of Education, Employment and Workplace Relations of Australia.

The United Nations Conference on Trade and Development (UNCTAD) recompiles statistics about the export and import of goods and services related to the creative industries.

The Australian Copyright Council (ACC) has been consistently compiling reports using the WIPO-guided framework on the impact of the copyright-based industries to Australia's economy in 2011,[166] 2012,[167] and 2014.

[168] In the most up-to-date WIPO-supported study published in 2017,[169] the copyright industries contributed $122.8 billion to the Australian economy in 2016 amounting to 7.4% of Australia's total economic output.

It is estimated that roads contribute to more than A$245 billion, to the economic activity, significantly serving to agriculture, forestry, fishing, manufacturing and construction industries.

Regional franchising businesses, now a $128 billion sector, have been operating co-branded sites overseas for years with new investors coming from Western Australia and Queensland.

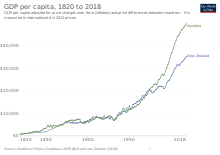

[176] According to the Reserve Bank of Australia, Australian per capita GDP growth is higher than that of New Zealand, US, Canada and The Netherlands.

[180] There is substantial export to China of iron ore, wool and other raw materials, and over 120,000 Chinese students study in Australian schools and universities.

In early 2014 it was reported that the Australia's special investor visa was granted to 65 mostly Chinese millionaires who brought over $440 million into the country.

[186][187] One of the factors that undermines balance of payments is Australia's export base, making it highly vulnerable to the volatility in the prices of commodity goods.

As long as the investment that is being funded by overseas capital inflow generates sufficient returns to pay for the servicing costs in the future, the increase in foreign liabilities can be viewed as sustainable in the longer term.

Compared to the rest of the world, very few Australians had a net worth of less than US$1,000, which was attributed to relatively low credit card and student loan debt.

The report explained that this partly reflects a large endowment of land and natural resources relative to population, and also high urban real estate prices.

Australia was especially attractive to Chinese millionaires due to its relative proximity, cleaner environment, political and economic stability, and investor visa programs.

Also, the primary reason for millionaires leaving China is top schools abroad that will give their children a better education and career connections.

[200][201][202] In 2008 the Treasurer and the Minister for Climate Change and Water released a report that concluded the economy will grow with an emissions trading scheme in place.

[206] Small changes caused by global warming, such as a longer growing season, a more temperate climate and increased CO2 concentrations, may benefit Australian crop agriculture and forestry in the short term.