Benefit corporation

[2] A company chooses to become a benefit corporation in order to operate as a traditional for-profit business while simultaneously addressing social, economic, and/or environmental needs.

Public benefit companies may only draw their stated goals from a closed list codified in law, and are prohibited from distributing dividends.

[29] Historically, U.S. corporate law has not been structured or tailored to address the situation of for-profit companies that wish to pursue a social or environmental mission.

The idea that a corporation has as its purpose to maximize financial gain for its shareholders was first articulated in Dodge v. Ford Motor Co. in 1919.

Thus a corporation may be unable to maintain its focus on social and environmental factors in a change of control situation because of the pressure to maximize shareholder value.

Mission-driven businesses, impact investors, and social entrepreneurs are constrained by this legal framework, which is not equipped to accommodate for-profit entities whose mission is central to their existence.

Without clear case law, directors may still fear civil claims if they stray from their fiduciary duties to the owners of the business to maximize profit.

[4] By contrast, benefit corporations expand the fiduciary duty of directors to require them to consider non-financial stakeholders as well as the interests of shareholders.

[35] Benefit corporation laws address concerns held by entrepreneurs who wish to raise growth capital but fear losing control of the social or environmental mission of their business.

In addition, the laws provide companies the ability to consider factors other than the highest purchase offer at the time of sale, in spite of the ruling on Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc. Chartering as a benefit corporation also allows companies to distinguish themselves as businesses with a social conscience, and as one that aspires to a standard they consider higher than profit-maximization for shareholders.

[36] Yvon Chouinard, founder of Patagonia, has written "Benefit corporation legislation creates the legal framework to enable companies like Patagonia to stay mission-driven through succession, capital raises, and even changes in ownership, by institutionalizing the values, culture, processes, and high standards put in place by founding entrepreneurs.

If a firm makes donations to a qualifying non-profit the charitable contributions receive a tax deductible status.

This will lower a firm's taxes compared to a typical C-corporation that is not donating money and only focusing on short term profits.

[40] Furthermore, firms that transition typically experience advantages in retaining employees, increasing their customer loyalty and attracting prospective talent that will mesh well into the company culture.

The term public benefit corporation (PBC) or another abbreviation may be added to the entity's name if the founders choose.

Dissenter's rights mean that those that vote against the amendment and qualify, may require the company to buy back their shares at fair value before the change.

[40] Firms making the transition should also perform a "due diligence review" of their business contracts, affairs and status in order to avoid any unforeseen liability associated with changing the form of the entity.

[40] According to William Mitchell Law Review journal, about 68 million US customers have a preference for making decisions about their purchases based on a sense of environmental or social responsibility.

[42] The Mitchell Law Review also states that around 49% of Americans have at some point in time boycotted firms whose behavior they see as "not in the best interest of society.

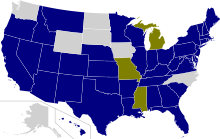

Passed into law.

No existing law.

Bill failed a vote in the state's legislature.