BRIC

BRIC is a term describing the foreign investment strategies grouping acronym that stands for Brazil, Russia, India, and China.

[7] In a 2023 retrospective article, O'Neill commented that after the term's initial proposal, it gained an outsized popularilty in the 2000s and 2010s to explain the economic conditions of the four countries.

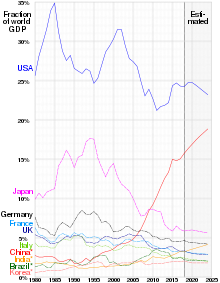

"[12] In 2001, Jim O'Neill, a global economist at Goldman Sachs at the time, proposed that the economic potential of Brazil, Russia, India and China is such that they could become among the most dominant economies by 2050.

[14][clarification needed] The BRIC thesis recognizes that Brazil, Russia, India and China have changed their political systems to embrace global capitalism.

[17] The report also highlights India's inefficient energy consumption at the time as well as the dramatic under-representation of these economies in the global capital markets.

The report also emphasizes the enormous populations that exist within the BRIC nations, which makes it relatively easy for their aggregate wealth to eclipse the G6, while per-capita income levels remained far below the norm of today's industrialized countries.

The report cites India and China as examples of countries which had already begun making their presence felt in the service and manufacturing sector respectively in the global arena, with developed economies already taking note of this.

Goldman Sachs asserts that "India's influence on the world economy will be bigger and quicker than implied in our previously published BRICs research".

They noted significant areas of research and development and expansion that is happening in the country, which the report predicts would lead to the prosperity of the growing middle class.

[18] In the revised 2007 figures, based on increased and sustaining growth, more inflows into foreign direct investment, Goldman Sachs predicts that "from 2007 to 2020, India's GDP per capita in US$ terms will quadruple", and that the Indian economy will surpass the United States (in US$) by 2043.

[21] The head of emerging markets for Morgan Stanley Investment Management, Ruchir Sharma, released a book in 2012 entitled Breakout Nations.

It also suggests that, while economic arguments can be made for linking Mexico into the BRIC thesis, the case for including South Korea looks considerably weaker.

From 2020 to 2050, nine of the ten largest countries by incremental GDP are occupied by the BRICs and N11 nations, in which the United States remains to be the only G7 member as one of the three biggest contributors to the global economic growth.

[31] According to The World Bank Doing Business report 2019 the BRIC economies introduced a total of 21 reforms, with getting electricity and trading across borders the most common areas of improvement.

Some of these sources claim that President Vladimir Putin of Russia was the driving force behind this original cooperative coalition of developing BRIC countries.

According to Jim O'Neill of Goldman Sachs who originally coined the term, Africa's combined current gross domestic product is reasonably similar to that of Brazil and Russia, and slightly above that of India.

[6] In the original essay that coined the term, Goldman Sachs did not argue that the BRICs would organize themselves into an economic bloc, or a formal trading association which this move signifies.

If investors read Goldman's research carefully and agreed with the conclusions, then they would gain exposure to Asian debt and equity markets rather than to Latin America.

At issue are the multiple serious problems which confront Russia (potentially unstable government, environmental degradation, critical lack of modern infrastructure, etc.

Government policies have favored investment (lowering interest rates), retiring foreign debt and expanding growth, and a reformulation of the tax system is being voted in the congress.

[39] By doing so, these institutional investors have contributed to the financial and economic development of key emerging nations such as Brazil, India, China, and Russia.

For global investors, India and China constitute both large-scale production platforms and reservoirs of new consumers, whereas Russia is viewed essentially as an exporter of oil and commodities- Brazil and Latin America being somehow "in the middle".

[40] As David Rothkopf wrote in Foreign Policy, "Without China, the BRICs are just the BRI, a bland, soft cheese that is primarily known for the whine [sic] that goes with it.

[citation needed] While China and India are manufacturing-based economies and rely on imports, Brazil and Russia are large exporters of natural resources.

Because of the popularity of the Goldman Sachs thesis "BRIC", this term has sometimes been extended whereby "BRICK"[51][52] (K for South Korea) and "BRIMC"[48][49] (M for Mexico) refer to these proposed expansions.

First, the term "The Next Eleven" referred to Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam, arguing they would be among the world's largest economies in the 21st century.

[65] Primarily, along with the BRICs,[66] Goldman Sachs argues that the economic potential of Brazil, Russia, India, Mexico and China is such that they may become (with the United States) the six most dominant economies by 2050.

Due to Mexico's rapidly advancing infrastructure, increasing middle class and rapidly declining poverty rates it is expected to have a higher GDP per capita than all but three European countries by 2050, this newfound local wealth also contributes to the nation's economy by creating a large domestic consumer market which in turn creates more jobs.

South Korean workers are the wealthiest among major Asian countries, with a higher income than Japan and the strongest growth rate in the OECD.

[citation needed] According to Citibank, South Korea will continue by overtaking Germany, Britain, Australia and Sweden by 2020, surpassing Canada, Switzerland, Netherlands and Norway by 2030 and taking over the United States by 2040 to become the world's wealthiest major economy.