Banking as a service

Of utmost importance is the assurance that proper mechanisms are in place to provide security, such as strong authentication and additional measures to protect sensitive information from unauthorized access throughout the entire process.

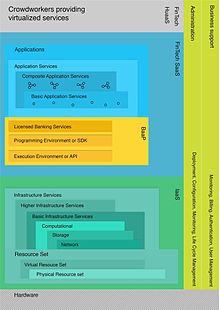

Fintech is “a business that aims at providing financial services by making use of software and modern technology.” [2] Skinner suggested a 3-layer representation of the BaaS stack.

This does, however, present a challenge in verifying that none of the plugged-in services will violate regulations that have been imposed by banking authorities.

Humans as a service [4] represents the top layer of the proposed revision of the BaaS stack.

This is a behind the scenes component that end-users will be unable to discern between a complete automated service and one that includes HuaaS.

White label banking can be an answer to the challenge platform providers face in attaining customers.

In Europe, BaaS for fintechs is overseen by the Payment Services Directive (PSD, 2007/64/EC) and its 2nd amendment (PSD2) that was adopted in November 2015.

[7] Banking licenses are overseen by competent national authorities in accordance to Directive 2013/36/EU and Article 14 of Regulation (EU) No 1024/2013.

[12] Asia has a strong disadvantage because of its high fragmentation of jurisdiction areas compared to Europe.

Fintechs can plug into the national banking-as-a-service hub to provide their specific regulated and licensed face to their customers.

[3] Fintechs in Africa have provided an original financing solution in a previously unserved and untapped banking market.

Because it is primarily mobile-based, Africa fintech is subject to national jurisdiction in regards to regulating financial markets and mobile telecommunications.

[13] Australia's government is behind in regulating fintech in comparison to the European Payment Services Directive.