Brent Crude

Brent is the leading global price benchmark for Atlantic basin crude oils.

It is used to set the price of two-thirds of the world's internationally traded crude oil supplies.

It is one of the two main benchmark prices for purchases of oil worldwide, the other being West Texas Intermediate (WTI).

ICE Clear Europe acts as the central counterparty for Brent crude oil and related contracts.

[7] In addition to ICE, two types of Brent crude financial futures are also traded on the NYMEX (now part of the Chicago Mercantile Exchange (CME).

Hedgers could use a Crude Diff or 'Dated to Front Line' (DFL) contract, which is a spread contract between Dated Brent and Brent 1st Line Future (the front month future), to hedge the basis risk.

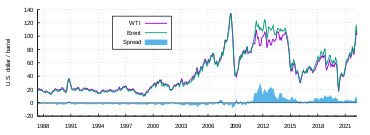

In February 2011 the divergence reached $16 during a supply glut, record stockpiles, at Cushing, Oklahoma before peaking at above $23 in August 2012.

It has since (September 2012) decreased significantly to around $18 after refinery maintenance settled down and supply issues eased slightly.

Many reasons have been given for this divergence ranging from regional demand variations, to the depletion of the North Sea oil fields.

Much US and Canadian crude oil from the interior is now shipped to the coast by railroad, which is much more expensive than pipeline.

[15][16] Sellers of Brent forward contracts initially had to give buyers a notice of at least 15 days of intention to deliver.

[18] Producers and refiners buy and sell oil on the market for wholesale trade, hedging, and tax purposes.

Integrated oil producers (those with refinery operations) had the same motives, but had an extra incentive to lower taxes.

[28][29] Spot market transactions are generally not public, so market participants usually analyzed Dated Brent prices using assessments from Price Reporting Agencies (PRAs), who collect private transactions data and aggregate them.

Trading in these windows are dominated by group of major market participants, as listed in the table below.

[34][35][36][37] But it is also a backronym or mnemonic for the formation layers of the oil field: Broom, Rannoch, Etive, Ness and Tarbert.

[38] Petroleum production from Europe, Africa, and the Middle East flowing West tends to be priced relative to this oil, i.e. it forms a benchmark.

The index represents the average price of trading in the 25-day Brent Blend, Forties, Oseberg, Ekofisk (BFOE) market in the relevant delivery month as reported and confirmed by the industry media.