CFA franc

The currency has been criticized for restricting the sovereignty of the African member states, effectively putting their monetary policy in the hands of the European Central Bank.

[5] Despite initial plans for a monetary union by late 2020, setbacks including the COVID-19 pandemic, global geopolitical uncertainties, and failure to meet criteria resulted in a postponement until 2027.

A couple of nations in West Africa have also chosen to adopt the CFA franc since its introduction, despite the fact that they had never been French colonies.

[3] The European Union's 2008 assessment of the CFA's link to the euro noted that "benefits from economic integration within each of the two monetary unions of the CFA franc zone, and even more so between them, remained remarkably low" but that "the peg to the French franc and, since 1999, to the euro as exchange rate anchor is usually found to have had favourable effects in the region in terms of macroeconomic stability".

[19] Critics point out that the currency is controlled by the French treasury, and in turn African countries channel more money to France than they receive in aid and have no sovereignty over their monetary policies.

The countries using the currency will no longer have to deposit half of their foreign exchange reserves with the French Treasury.

[20] In December 2024, in a report adopted by the French Foreign Affairs Committee, it was published that the reform of the CFA franc in 2019 had been incomplete, largely due to the reluctance of African heads of state to complete it.

The French perceive the guarantee provided to the CFA franc, and the assurance of its convertibility, as a pillar of economic stability for the region.

[24] It is issued by the BCEAO (Banque Centrale des États de l'Afrique de l'Ouest, i.e., "Central Bank of the West African States"), located in Dakar, Senegal, for the eight countries of the UEMOA (Union Économique et Monétaire Ouest Africaine, i.e., "West African Economic and Monetary Union"): These eight countries have a combined population of 147.6 million people (as of 2023),[10] and a combined GDP of US$199.4 billion (as of 2023).

[11] In 1975, Central African CFA banknotes were issued with an obverse unique to each participating country, and common reverse, in a fashion similar to euro coins.

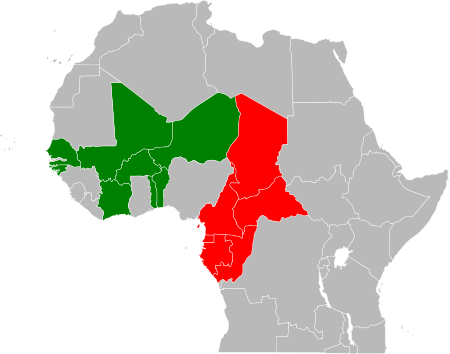

West African CFA franc (XOF)

Central African CFA franc (XAF)