ATM

If the currency being withdrawn from the ATM is different from that in which the bank account is denominated, the money will be converted at the financial institution's exchange rate.

[19] The roll-out of this machine, called Bankograph, was delayed by a couple of years, due in part to Simjian's Reflectone Electronics Inc. being acquired by Universal Match Corporation.

[21] In 1962 Adrian Ashfield invented the idea of a card system to securely identify a user and control and monitor the dispensing of goods or services.

A cash machine was put into use by Barclays Bank, Enfield, north London in the United Kingdom, on 27 June 1967, which is recognized as the world's first ATM.

[27] This invention is credited to the engineering team led by John Shepherd-Barron of printing firm De La Rue,[28] who was awarded an OBE in the 2005 New Year Honours.

[29][30] Transactions were initiated by inserting paper cheques issued by a teller or cashier, marked with carbon-14 for machine readability and security, which in a later model were matched with a four-digit personal identification number (PIN).

[35] The collaboration of a small start-up called Speytec and Midland Bank developed a fourth machine which was marketed after 1969 in Europe and the US by the Burroughs Corporation.

Both the DACS and MD2 accepted only a single-use token or voucher which was retained by the machine, while the Speytec worked with a card with a magnetic stripe at the back.

[26] Devices designed by British (i.e. Chubb, De La Rue) and Swedish (i.e. Asea Meteor) manufacturers quickly spread out.

[46] To show confidence in Docutel, Chemical installed the first four production machines in a marketing test that proved they worked reliably, customers would use them and even pay a fee for usage.

The Identikey system consisted of a card reader console, two customer PIN pads, intelligent controller and built-in electronic interface package.

[57] In 2012, a new ATM at Royal Bank of Scotland allowed customers to withdraw cash up to £130 without a card by inputting a six-digit code requested through their smartphones.

Some examples of interbank networks include NYCE, PULSE, PLUS, Cirrus, AFFN, Interac,[64] Interswitch, STAR, LINK, MegaLink, and BancNet.

However, based on the economies of scale, the price of equipment has dropped to the point where many business owners are simply paying for ATMs using a credit card.

[82] With the migration to commodity Personal Computer hardware, standard commercial "off-the-shelf" operating systems and programming environments can be used inside of ATMs.

[85] With the move to a more standardised software base, financial institutions have been increasingly interested in the ability to pick and choose the application programs that drive their equipment.

Early ATM security focused on making the terminals invulnerable to physical attack; they were effectively safes with dispenser mechanisms.

Another attack method, plofkraak (a Dutch term), is to seal all openings of the ATM with silicone and fill the vault with a combustible gas or to place an explosive inside, attached, or near the machine.

[89] ATM bombings began in the Netherlands, but as the nation reduced the number of machines in the country from 20000 to 5000 and discouraged cash use, the mostly Moroccan-Dutch gangs expert in the attacks moved elsewhere.

Despite German banks spending more than €300 million on additional security, the Federal Criminal Police Office estimated that as of 2024[update] 60% of attacks on ATMs in the country succeeded.

[95][96] Alternative methods to verify cardholder identities have been tested and deployed in some countries, such as finger and palm vein patterns,[97] iris, and facial recognition technologies.

Alarm sensors are placed inside ATMs and their servicing areas to alert their operators when doors have been opened by unauthorised personnel.

[99] Customers often commented that it is difficult to recover money lost in this way, but this is often complicated by the policies regarding suspicious activities typical of the criminal element.

[102] Consultants of ATM operators assert that the issue of customer security should have more focus by the banking industry;[103] it has been suggested that efforts are now more concentrated on the preventive measure of deterrent legislation than on the problem of ongoing forced withdrawals.

[104] At least as far back as 30 July 1986, consultants of the industry have advised for the adoption of an emergency PIN system for ATMs, where the user is able to send a silent alarm in response to a threat.

By modifying the inner workings of a Fujitsu model 7020 ATM, a criminal gang known as the Bucklands Boys stole information from cards inserted into the machine by customers.

[142] WAVY-TV reported an incident in Virginia Beach in September 2006 where a hacker, who had probably obtained a factory-default administrator password for a filling station's white-label ATM, caused the unit to assume it was loaded with US$5 bills instead of $20s, enabling himself—and many subsequent customers—to walk away with four times the money withdrawn from their accounts.

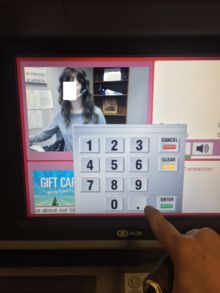

[144] In an attempt to prevent criminals from shoulder surfing the customer's personal identification number (PIN), some banks draw privacy areas on the floor.

EMV is widely used in the UK (Chip and PIN) and other parts of Europe, but when it is not available in a specific area, ATMs must fall back to using the easy–to–copy magnetic stripe to perform transactions.

[150] In 1996, Andrew Stone, a computer security consultant from Hampshire in the UK, was convicted of stealing more than £1 million by pointing high-definition video cameras at ATMs from a considerable distance and recording the card numbers, expiry dates, etc.