Ghanaian cedi

Ghana's first President Kwame Nkrumah introduced Cedi notes and Pesewa coins in July 1965 to replace the Ghanaian pounds, shillings and pence.

The Monetaria moneta or money cowry is not native to West African waters but is a common species in the Indian Ocean.

This had the effect of driving nearly all commerce underground, where black market prices for commodities were the norm, and nothing existed on store shelves.

By 1983, one U.S. dollar equalled about 120 cedis on the black market; a pack of cigarettes cost about ₵150 (if they could be found), but the bank rate continued at ₵2.80 = $1.00.

Finally, with foreign currency completely drying up for all import transactions, Ghana was forced to begin a process of gradual devaluation, as well as a liberalization of its strict price controls.

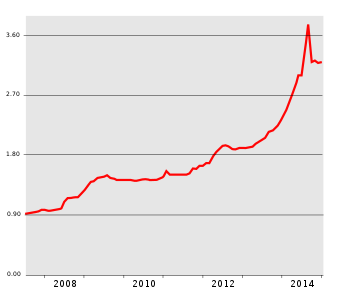

Inflation continued (see the exchange rate chart) until by July 2007, one US dollar was worth about ₵9500, and a transition to the third cedi was initiated.

However, many Ghanaians who were hoarding large amounts of cedis feared reprisal if they tried to convert all of it, and so simply burned a lot of their money.

This confiscation of money was publicly justified as a means to create a disincentive for the flourishing black market.

However, from a monetary perspective, currency confiscations have the effect of reducing available cash reserves in the economy of Ghana, thereby slowing the rate of inflation.

This fear, along with inflation running at about 100% annually, started causing Ghanaians to lose their faith in their country's own currency.

[5] Due to periods of "sustained high inflation" and "perennial depreciation of the currency", the Bank of Ghana on 29 November 2019, announced the issuance of a new 2-cedi coin and as well as new 100 and 200-cedi banknotes.

Existing 1 and 2 cedi banknotes remain legal tender, though these denominations will be gradually replaced by coins to reduce costs.

[6] The devaluation was temporarily halted in the last quarter of 2014 as the currency stabilized due to a pending IMF bailout of Ghana.

In September 2021, the Bank of Ghana began the process of withdrawing GH₵1 and GH₵2 notes from circulation to encourage the use of coins of their corresponding face values.

[8][9] In August 2022, accelerating inflation and continued economic mismanagement has caused the cedi's value to drop to 10 U.S. cents (GH₵10 = US$1).

[10] As of September 2022[update], the annual inflation rate of 37.2% as reported by the Ghana Statistical Service was the highest since 2001.

[11] By October 2022, the cedi became the world's worst performing currency, having lost 60% of its value relative to the U.S. dollar since the end of 2021.