Foundation (nonprofit)

Nevertheless, the term "foundation" might also be adopted by organizations not primarily engaged in public grantmaking.

[1] Legal entities existing under the status of "foundations" have a wide diversity of structures and purposes.

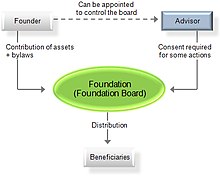

Unlike a company, foundations have no shareholders, though they may have a board, an assembly and voting members.

A foundation may hold assets in its own name for the purposes set out in its constitutive documents, and its administration and operation are carried out in accordance with its statutes or articles of association rather than fiduciary principles.

More than 250 charitable German foundations have existed for more than 500 years; the oldest dates back to 1509.

There are also large German corporations owned by foundations, including Bertelsmann, Bosch, Carl Zeiss AG and Lidl.

In Italy, a foundation is a private non-profit and autonomous organization, its assets must be dedicated to a purpose established by the founder.

Article 16 CC establishes that the foundation's statutes must contain its name, purpose, assets, domicile, administrative organs and regulations, and how the grants will be distributed.

Foundations must designate and pursue at least one of twenty-five public benefit goals defined by law.

[9] Foundations in Spain are organizations founded with the purpose of not seeking profit and serving the general needs of the public.

The designation depends on factors such as the charity's structure, funding sources, and mode of operation.

Charities receive notification of their designation from the Canada Revenue Agency (CRA) upon registration.

To be designated as a charitable organization or public foundation, more than half of the directors, trustees, or officials must be at arm's length.

The CRA applies specific criteria to determine the designation, including the charity's purposes, activities, income allocation, and relationships with officials and donors.

The definition usually applied is that from the Pemsel Case of English jurisprudence (1891) and the Irish Income Tax Act 1967.

A consultation paper presenting a general discussion on foundations was brought forth to the Jersey government concerning this possibility.

However, the Internal Revenue Code distinguishes between private foundations (usually endowed by an individual, family, or corporation) and public charities (community foundations or other nonprofit groups that raise money from the general public).

While they offer donors more control over their charitable giving, private foundations have more restrictions and fewer tax benefits than public charities.