International status and usage of the euro

Its growing use in this regard has led to its becoming the only significant challenger to the U.S. dollar as the world's main reserve currency.

After years of negotiations, partially over concerns with banking secrecy,[16] the EU and Andorra signed a monetary agreement on 30 June 2011 which made the euro the official currency in Andorra and allowed them to mint their own euro coins as early as 1 July 2013, provided they comply with the agreement's terms.

[21][22][23][24] The first OCTs to adopt the euro through a monetary agreement were the French overseas territories of Saint-Pierre-et-Miquelon, located off the coast of Canada, and Mayotte in the Indian Ocean.

Former European Central Bank president Jean-Claude Trichet stated that the ECB – which does not grant representation to those who unilaterally adopt the euro – neither supports nor deters those wishing to use the currency.

Additionally, it is sometimes used for pricing purposes even when actual payments are made in the official currency (e.g., for real estate).

Also, a large number of petrol stations and motorway service areas in European countries outside the eurozone accept euros, and Poland (as well as non-EU members Bosnia and Herzegovina and Serbia) allow payment of highway tolls in euros.

[citation needed] In Northern Ireland, which shares a land border with the eurozone, the euro is accepted in some shops, including many chain stores.

[45] From April 2009 to June 2019,[46] the Zimbabwean dollar was no longer in active use after it was officially suspended by the government due to hyperinflation.

The United States dollar (US$), South African rand (R), Botswanan pula (P), pound sterling (£), euro (€), Indian rupee (₹), Australian dollar (A$), Chinese yuan (元/¥), and Japanese yen (¥) were used instead, along with U.S.-cent denominated Zimbabwean bond coins and bond notes.

[47][48] In 1998, Cuba announced that it would replace the U.S. dollar with the euro as its official currency for the purposes of international trading.

[50] Since 2007, Iran has asked all petroleum customers to pay in non-U.S. dollar currency in response to American sanctions.

In 2018, in response to U.S. sanctions, the Venezuelan Minister of Industries and National Production Tareck El Aissami announced that all foreign exchange government auctions will no longer be quoted in U.S. dollars and would use euros, Chinese yuan and other hard currencies instead.

El Aissami said the government would open bank accounts in Europe and Asia as potential workarounds to financial sanctions.

In addition, Venezuela's banking sector will now be able to participate in currency auctions three times a week, adding that the government would sell some 2 billion euros amid a rebound in oil prices.

The euro is seen as a stable currency, i.e., there are no dramatic appreciations or depreciations of its value that might suddenly damage the economy or harm trade.

In 2015, the Central Bank updated the weights of the peg to 60% for the Euro and 40% for the US dollar, against respectively 80% and 20% previously, to better reflect the current structure of foreign trade of the country.

[59] Inheriting this status from the German mark, its share of international reserves has risen from 23.65% in 2002 to a peak of 27.66% in 2009 before declining due to the European debt crisis, with Russia and Eastern Europe being the most significant users.

"[63] As of 2021, however, the euro has not displaced the U.S. dollar as primary reserve currency due to the European debt crisis.

[citation needed] The euro's stability and future existence was doubted and its share of global reserves fell to 19% by year-end 2015 (compared to 66% for the U.S. dollar).

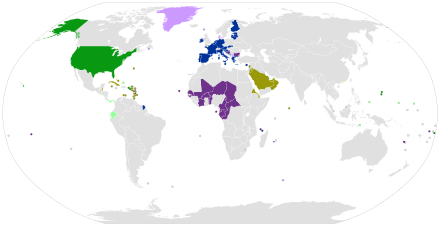

- European Union member states ( special territories not shown)

-

20 in the eurozone5 not in ERM II, but obliged to join the eurozone on meeting the convergence criteria ( Czech Republic , Hungary , Poland , Romania , and Sweden )

- Non–EU member states