Cyclically adjusted price-to-earnings ratio

[4] Value investors Benjamin Graham and David Dodd argued for smoothing a firm's earnings over the past five to ten years in their classic text Security Analysis.

From the 1940s, Sir John Templeton used a method adapted from Graham and Dodd, and somewhat similar to the later Shiller P/E, but with the Dow Jones Industrial Index.

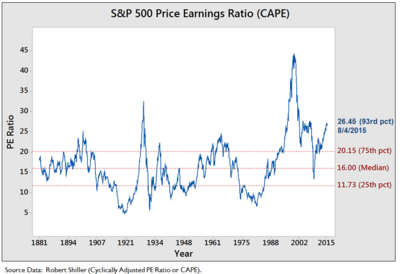

Using market data from both estimated (1881–1956) and actual (1957 onward) earnings reports from the S&P index, Shiller and Campbell found that the lower the CAPE, the higher the investors' likely return from equities over the following 20 years.

After Fed President Alan Greenspan coined the term in 1996, the CAPE ratio reached an all-time high during the 2000 dot-com bubble.

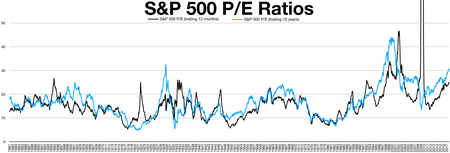

[9] The measure exhibits a significant amount of variation over time, and has been criticized as "not always accurate in signaling market tops or bottoms".

[10] This debate regained currency in 2014 as the CAPE ratio reached an all-time high[citation needed] in combination with historically very low rates on 10 year Treasuries.

Recently, investors have sought an improvement to CAPE that reflects the fact that, in general, companies don’t pay out all their earnings as dividends each year.