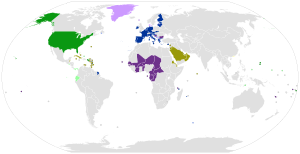

Dedollarisation

[1] It also entails the creation of an alternative global financial and technological system in order to gain more economic independence by circumventing the dependence on the Western World-controlled systems, such as SWIFT financial transfers network for the international trade and payments, which could be economically weaponised by America and its Western World allies against other nations.

[2] The U.S. dollar began to displace the pound sterling as the international reserve currency from the 1920s since it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows.

[8] BNN Bloomberg reports: The reserve status of the dollar is declining more rapidly than commonly acknowledged, with numerous analysts overlooking the significant exchange rate fluctuations from the previous year.

Argentina has been facing a significant decline in agricultural exports due to a severe drought, resulting in reduced inflow of dollars.

[15] In a similar vein, ASEAN members gathered in Indonesia to discuss strategies for reducing their reliance on the dollar, euro, yen, and pound sterling in financial transactions, and instead promote the use of their domestic currencies.

[16] In April 2023, Bolivian President Luis Arce revealed that the government is actively considering the adoption of China's yuan as an alternative to the U.S. dollar for conducting international trade.

[17][18] The decision stems from Bolivia's ongoing challenge of insufficient liquidity in domestic markets, with shortages of U.S. dollars escalating since early 2023, due to the declining net international reserves.

[22][23] In December 2022 at the China - GCC Summit, President Xi Jinping called for oil trade payments to be settled at yuan.

As a response, on 31 March 2022 Russian president Vladimir Putin signed a decree mandating unfriendly countries from April 1 to pay the natural gas imports in rubles.

[28][29] European leaders have initially rejected paying for deliveries in rubles, marking that such a move would undermine sanctions already imposed on Moscow.

The Islamic Republic of Iran is also striving to apply blockchain technology and digital currencies to bypass the international financial system and likewise to reduce the effect of sanctions.

On the other hand, according to Malaysia, the de-dollarization and lower demand of the country in order to apply the dollar in commercial transactions will be able to provide the ground for the stabilization of the ringgit (its local currency).

[37] In September 2022, Gazprom CEO Alexey Miller said that they have signed an agreement to make trade payments in rubles and yuan instead of US dollars.

[38] In November 2022, Russian Deputy Prime Minister Alexander Novak confirmed that all gas supplied to China via Siberia are settled in rubles and yuan.

[41][42] In January 2023, Finance Minister of Saudi Arabia Mohammed Al-Jadaan stated that it is open to trade in other currencies besides the US dollar, and this expression is considered to be the first time in 48 years.

[43][44] Saudi Arabia accounts for more than 17% of the world's crude oil exports, with the majority directed towards Asia, especially to BRICS countries like China and India.

As BRICS advocates for reducing reliance on the US dollar, there is growing speculation that Saudi Arabia might start using non-dollar currencies for its oil trade, particularly with these two nations.

[60] The Russian Finance Ministry and Central Bank of Russia stated that it would sell around 54.5 billion rubles in foreign currency from January 2023.

[20] In a significant development, it has been reported that a French company has conducted a transaction with China National Offshore Oil Corporation recently, exporting liquefied gas (LNG) and accepting payment in Chinese yuan.

[73][74] Since the end of 2019, the EU countries established INSTEX, a European special-purpose vehicle (SPV) to facilitate non-USD and non-SWIFT[75][76] transactions with Iran to avoid breaking U.S.

[85][86] A group of Southeast Asian countries in the region, such as Singapore, Malaysia, Indonesia, Cambodia, and Thailand, are currently contemplating the process of de-dollarization in order to diminish their dependence on the US dollar within their economies.

[92] In May 2023, South Korea and Indonesia signed a memorandum of understanding to promote bilateral trade in national currencies, moving away from the US dollar as an intermediary.

[93][citation needed] In early May 2023, the central banks of South Korea and Indonesia entered into a Memorandum of Understanding (MoU) aimed at fostering collaboration in advancing the utilization of their respective currencies for bilateral transactions.

[95] As academic Tim Beal summarizes, many commentators view the United States' overly broad imposition of financial sanctions as a factor increasing dedollarisation because of responses like the Russian-developed System for Transfers of Financial Messages (SPFS), the China-supported Cross-Border Interbank Payment System (CIPS), and the European Instrument in Support of Trade Exchanges (INSTEX) that followed the United States' withdrawal of from the Joint Comprehensive Plan of Action (JCPOA) with Iran.

The majority of these instruments have been linked to the consumer price index (CPI) by establishing a unit of account known as the 'Unidad de Fomento' (UFs).

In a powerful speech delivered from a podium adorned with the flags of Brazil, Russia, India, China, and South Africa, collectively known as the BRICS nations, he urged the largest developing economies to collaborate and propose an alternative currency to replace the greenback in international trade.

President Lula da Silva questioned the decision-making process that led to the dollar becoming the primary trade currency after the abandonment of the gold standard.