Economy of Spain

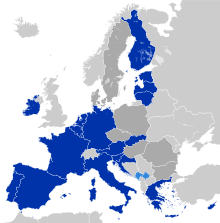

[50] At the second half of the 1990s, the conservative government of former prime minister Jose María Aznar had worked successfully to gain admission to the group of countries joining the euro in 1999.

By 2007, Spain had achieved a GDP per capita of 105% of European Union's average due to its own economic development and the EU enlargements to 28 members, which placed it slightly ahead of Italy (103%).

Three regions were included in the leading EU group exceeding 125% of the GDP per capita average level: the Basque Country, Madrid, and Navarre.

[66] The adoption of the euro in 2002 had driven down long-term interest rates, prompting a surge in mortgage lending that jumped fourfold from 2000 to its 2010 apex.

[67] In the first weeks of 2010, renewed anxiety about excessive debt in some EU countries and, more generally, about the health of the euro spread from Ireland and Greece to Portugal, and to a lesser extent Spain.

[citation needed] After having completed large improvements over the second half of the 1990s and during the 2000s, Spain attained in 2007 its record low unemployment rate, at about 8%,[78] with some regions on the brink of full employment.

This would improve Spain's weakened youth labor market, and their school to work transition, as young people have found it difficult to find long-term employment.

[97] As of 2017, trade unions, left, and center-left parties continued to criticize and wanted labor reform to be revoked, on grounds that it tilted the balance of power too far towards employers.

Members of the opposition argued this increase, would negatively affect 1.2 million workers due to employers being unable to cover the raise, resulting in higher unemployment.

[98] Contrary to such opinion, the reforms approved by Sanchez's government resulted in a robust shift towards permanent employment contracts, and led to a 15-year low in unemployment rates at 11.60%.

[40] In two years (2014–2015) the economy had recovered 85% of the GDP lost during the 2009-2013 recession,[41] which had some international analysts referring to Spain's recovery as "the showcase for structural reform efforts".

[102] Exports shot up, from around 25% (2008) to 33% of GDP (2016) on the back of an internal devaluation (the country's wage bill halved in 2008–2016), a search for new markets, and a mild recovery of the European economy.

[102] By 2017, following several months of prices increasing, homeowners who had been renting during the economic slump had started to put their properties back on the market.

[103] The phenomenon was most visible in big cities such as Barcelona or Madrid, which saw new record average prices, partially fueled by short-term rentals to tourists.

[107] Nevertheless, with the unprecedented crisis of the country's real estate sector, smaller local savings banks ("Cajas"), had been delaying the registering of bad loans, especially those backed by houses and land, to avoid declaring losses.

On 22 May 2010, the Banco de España took over "CajaSur", as part of a national program to put the country's smaller banks on a firm financial basis.

[109][circular reference] The international accounting firm, PricewaterhouseCoopers, estimated an imbalance between CAM's assets and debts of €3,500 million, not counting the industrial corporation.

By then it was becoming clear that the mounting real estate losses of the savings banks were undermining confidence in the country's government bonds, thus aggravating a sovereign debt crisis.

A retired urologist with Parkinson's disease gathered more than 600,000 signatures in an online petition "I'm Old, Not an Idiot" asking banks and other institutions to serve all citizens, and not discriminate against the oldest and most vulnerable members.

[115][116] During the 2009−early 2016 period, apart from temporary minor oil shocks, the Spanish economy has generally oscillated between slightly negative to near-zero inflation rates.

Analysts reckoned that this was not synonymous with deflation, due to the fact that GDP had been growing since 2014, domestic consumption had rebounded as well and, especially, because core inflation remained slightly positive.

[9] Since the 1990s some Spanish companies have gained multinational status, often expanding their activities in culturally close Latin America, Eastern Europe and Asia.

Six of the ten biggest international construction firms specialising in transport are Spanish, lincluding Ferrovial, Acciona, ACS, OHL and FCC.

[126] During 2013 Spanish civil engineering companies signed contracts around the world for a total of 40 billion euros, setting a new record for the national industry.

[38] Then, during the economic downturn, Spain reduced significantly imports due to domestic consumption shrinking while – despite the global slowdown – it has been increasing exports and kept attracting growing numbers of tourists.

[131] During this same period, from the 70 members of the World Trade Organization (whose combined economies amount to 90% of global GDP), Spain was the country whose exports had grown the most.

[101] In all, by 2017 foreign sales have been rising every year since 2010, with a degree of unplanned import substitution -a rather unusual feat for Spain when in an expansive phase- which points to structural competitive gains.

[133] The Spanish benchmark stock market index is the IBEX 35, which as of 2016 is led by banking (including Banco Santander and BBVA), clothing (Inditex), telecommunications (Telefónica) and energy (Iberdrola).

Spain's main customers are Latin America, Asia (Japan, China, India), Africa (Morocco, Algeria, Egypt) and the United States.

[156] In 2020, the food distribution sector was dominated by Mercadona (24.5% market share), followed by Carrefour (8.4%), Lidl (6.1%), DIA (5.8), Eroski (4.8), Auchan (3.4%), regional distributors (14.3%) and other (32.7%).

-

28-28.9

-

29-29.9

-

30-30.9

-

31-31.9

-

32-32.9

-

33-33.9

-

34-35.9