Emerging market

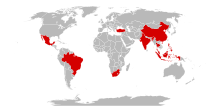

[7] The ten largest emerging economies by nominal GDP are 4 of the 9 BRICS countries (Brazil, Russia, India, and China) along with Mexico, South Korea, Indonesia, Turkey, Saudi Arabia, and Poland.

While researchers such as George Haley, Vladimir Kvint, Hernando de Soto, Usha Haley, and several professors from Harvard Business School and Yale School of Management have described activity in countries such as India and China, how a market emerges is now well understood and can easily be modeled.

Thomas Marois (2012, 2) argues that financial imperatives have become much more significant and has developed the idea of 'emerging finance capitalism' – an era wherein the collective interests of financial capital principally shape the logical options and choices of government and state elites over and above those of labor and popular classes.

According to his definition, an emerging economy displays the following characteristics:[15] At the beginning of the 2010s, more than 50 countries, representing 60% of the world's population and 45% of its GDP, matched these criteria.

[17] These countries do not share any common agenda, but some experts believe that they are enjoying an increasing role in the world economy and on political platforms.

In an Opalesque.TV video, hedge fund manager Jonathan Binder discusses the current and future relevance of the term "emerging markets" in the financial world.

[19] Egypt, Iran, Nigeria, Pakistan, Russia, Saudi Arabia,[20] Taiwan, and Thailand are other major emerging markets.

The exchange traded funds can be focused on a particular country (e.g., China, India) or region (e.g., Asia-Pacific, Latin America).

[22] While often treated as one group, emerging market economies are diverse in their factor endowments as well as real, financial, and external linkages.

NEST: Expected Incremental GDP in the next decade to be lower than the average of the G6 economies (G7 excluding the US) but higher than Italy's.

It provides full coverage of the EM asset class with representative countries, investable instruments (sovereign and quasi-sovereign), and transparent rules.

An existing country may be considered for removal from the index if its GNI per capita is above the Index Income Ceiling (IIC) for three consecutive years as well as the country's long term foreign currency sovereign credit rating (the available ratings from all three agencies: S&P, Moody's & Fitch) is A-/A3/A- (inclusive) or above for three consecutive years.

[33] J.P. Morgan has introduced what is called an "Index Income Ceiling" (IIC), defined as the income level that is adjusted every year by the growth rate of the World GNI per capita, provided by the World Bank as "GNI per capita, Atlas method (current US$) annually".

These economies are selected based on nominal gross domestic product (GDP) per capita, share in global trade and poverty levels.

Estimating the demand for products or services in emerging markets and developing economies can be complex and challenging for managers.

These countries have unique commercial environments and may be limited in terms of reliable data, market research firms, and trained interviewers.

However some companies have dedicated their entire business units for understanding the dynamics of emerging markets owing to their peculiarity.