Local government in England

Civil parishes are the lowest tier of local government, and primarily exist in rural and smaller urban areas.

The responsibilities of parish councils are limited and generally consist of providing and maintaining public spaces and facilities.

Local authorities cover the entirety of England, and are responsible for services such as education, transport, planning applications, and waste collection and disposal.

However, there are a number of other functions given by powers in the relevant legislation, which they can do, such as providing litter bins and building bus shelters.

[6] Their statutory functions are few, but they may provide other services with the agreement of the relevant local authorities,[7] and under the Localism Act 2011 eligible parish councils can be granted a "general power of competence" (GPC) which allows them within certain limits the freedom to do anything an individual can do provided it is not prohibited by other legislation, as opposed to being limited to the powers explicitly granted to them by law.

[27] Notably, Cornwall Council has been subject to a devolution deal, which are usually reserved to combined authorities for additional functions and funding.

[32] The former Leader of the Greater London Council, Ken Livingstone, served as the inaugural Mayor, until he was defeated by future Prime Minister Boris Johnson in 2008.

[35] Meanwhile, it is the Assembly's role to regularly hold the Mayor and their key advisers to account and it can also amend the budget or a strategy by a two-thirds majority, though this has not ever happened as of March 2022.

[7] The Secretary of State was first granted the power to create combined authorities by the Local Democracy, Economic Development and Construction Act 2009.

[37] The Cities and Local Government Devolution Act 2016 gave the Secretary of State the power to provide for a directly-elected combined authority mayor.

[53] In England, local authorities have three main sources of funding: UK Government grants, council tax and business rates.

[61] In the financial year 2019/20, local authorities received 22% of their funding from grants, 52% from council tax and 27% from retained business rates.

[61] In the financial year 2023/24, 51% of revenue expenditure is expected to come from UK Government grants, 31% from council tax and 15% from retained business rates.

[27] Local government can also receive some money from fees and charges for the use of services, returns and interest from investments, commercial income, fixed penalty notices and capital receipts.

[62] On a yearly basis, local government bodies review and consider whether to increase or decrease the level of council tax to fund their spending plans.

[62] Between financial years 2009/10 and 2021/22, council tax rates increased by 30% in real terms, in light of reduced grants from the UK Government.

[62] It is based on the rateable value of the premises (set by the Valuation Office Agency) and a business rate multiplier.

[61] It was initially planned to increase the proportion of business rates that local authorities retain to 100%, but this was indefinitely delayed in 2021.

In 2022, the Public Administration and Constitutional Affairs Committee said that it had "significant concerns about the current governance arrangements for England":[65]If the people within government are unsure at times where powers and responsibility, and hence accountability, rest, this lack of clarity is magnified for individuals who have little knowledge or experience of the structures.

[65]The Committee also said that "[t]he evidence is clear both practically and democratically that the overly centralised arrangements of government in England are problematic" and that reform was also needed of funding structures.

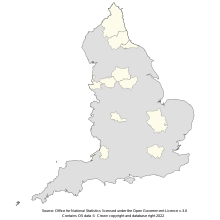

[65] As of May 2024, the various combined authorities, county, district, and sui generis councils formed an administrative hierarchy as shown in the table below.