European Union financial transaction tax

[2] Instead, the Council of the European Union authorized member states who wished to introduce the EU FTT to use enhanced co-operation.

According to the European Commission this would also "help to reduce competitive distortions in the single market, discourage risky trading activities and complement regulatory measures aimed at avoiding future crises".

[9] As a way out, advocates of the FTT such as the finance ministers from Germany, Austria and Belgium have suggested that the tax could initially be implemented only within the 17-nation eurozone, which would exclude reluctant governments like the United Kingdom and Sweden.

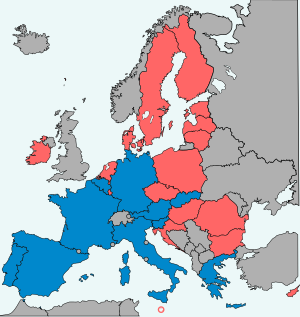

[6][12] In October 2012, after discussions failed to establish unanimous support for an EU-wide FTT, the European Commission proposed that the use of enhanced co-operation should be permitted to implement the tax in the states which wished to participate.

[4][20] The legal service of the Council of the European Union concluded in September 2013 that the European Commission's proposal would not tax "systemic risk" activities but only healthy activities, and that it was incompatible with the EU treaty on several grounds while also being illegal because of "exceeding member states' jurisdiction for taxation under the norms of international customary law".

"[25] The following month, Algirdas Šemeta, European Commissioner for Taxation and Customs Union, Audit and Anti-Fraud, said that "The Commission is ready to examine the suggestions made for an initial introduction of the tax with lower rates for products of specific market segments" including "both government bonds and pension funds."

House mortgages, bank loans to small and medium enterprises, contributions to insurance contracts, as well as spot currency exchange transactions and the raising of capital by enterprises or public bodies through the issuance of bonds and shares on the primary market would not be taxed, with the exception of trading bonds on secondary markets.

Lyndon Harrison, chair of the committee, suggested that "although the European Commission denies it, it is our view that UK authorities will be under an obligation to collect the tax.

"[37] A report, commissioned by the City of London Corporation, which was published in April 2013 claimed that the tax would raise the UK's debt financing costs by £4 billion.

[38] On 3 April 2013, Czech Prime Minister Petr Nečas said that the FTT was unacceptable, and refused to rule out challenging it with the European Court of Justice.

[39] In April 2013, George Osborne, the UK's Chancellor of the Exchequer, announced that his country had filed a legal challenge of the decision authorizing the use of enhanced cooperation to implement the FTT with the European Court of Justice.

"[42] Luxembourg's Minister for Finance Luc Frieden said that his country was "very sympathetic" to the UK's legal challenge and would "bring arguments in support of the case".

[43] On 30 April 2014, the European Court of Justice dismissed the United Kingdom's action against the authorization of the use of enhanced cooperation,[44] but didn't rule out the possibility the UK could challenge the legality of the FTT itself if it is eventually approved.

[22] Algirdas Semeta, European Commissioner, responded to the opinion by stating that the commission would continue working on the FTT and that "the approach which has been taken in the proposal is the correct one and does not breach any provisions of the Treaty.

[50][51] Avinash Persaud of Intelligence Capital, Sony Kapoor of Re-Define and Stephany Griffith-Jones of Columbia University have all welcomed the suggested financial transaction tax which, they argued would hit the right players, such as high frequency traders and intermediary financial players, and not the real economy,[52][53] and which could lead to a 0.25% increase in GDP.

We are clearly not arguing that on its own, the FTT would reduce the risk of crises, as prudent macroeconomic policies and effective financial regulation as well as supervision also have a major role to play in crisis prevention.

"[56]In May 2012, member of the executive board of the European Central Bank Jörg Asmussen also spoke out in favour of an EU FTT, citing additional revenues and justice to be the main reasons.

A Eurobarometer poll of more than 27,000 people published in January 2011 found that Europeans are strongly in favour of a financial transaction tax by a margin of 61% to 26%.

Another survey published earlier by YouGov suggests that more than four out of five people in the UK, France, Germany, Spain and Italy think the financial sector has a responsibility to help repair the damage caused by the economic crisis.