FairTax

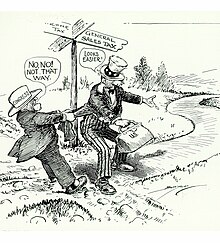

The Fair Tax Act calls for elimination of the Internal Revenue Service[1] and repeal the Sixteenth Amendment to the United States Constitution.

Talk radio personality Neal Boortz and Georgia Congressman John Linder published The FairTax Book in 2005 and additional visibility was gained in the 2008 presidential campaign.

Supporters believe it would increase civil liberties, benefit the environment, and effectively tax illegal activity and undocumented immigrants.

These included uncertainties as to the revenue that would be generated, and difficulties of enforcement and administration, which made this type of tax undesirable to recommend in their final report.

[5] During the first year of implementation, the FairTax legislation would apply a 23% federal retail sales tax on the total transaction value of a purchase; in other words, consumers pay to the government 23 cents of every dollar spent in total (sometimes called tax-inclusive, and presented this way to provide a direct comparison with individual income and employment taxes which reduce a person's available money before they can make purchases).

Buying or otherwise receiving items and services not subject to federal taxation (such as a used home or car) can contribute towards a lower effective tax rate.

[2] The Social Security Administration would disburse the monthly rebate payments in the form of a paper check via U.S. Mail, an electronic funds transfer to a bank account, or a "smartcard" that can be used like a debit card.

[36] In addition, economist Bruce Bartlett has argued that the rebate would create a large opportunity for fraud,[37] treats children disparately, and would constitute a welfare payment regardless of need.

[9][39] Estimated by the advisory panel at approximately $600 billion, "the Prebate program would cost more than all budgeted spending in 2006 on the Departments of Agriculture, Commerce, Defense, Education, Energy, Homeland Security, Housing and Urban Development, and Interior combined.

These studies presumably incorporated some degree of tax evasion in their calculations by using National Income and Product Account based figures, which is argued to understate total household consumption.

Beacon Hill Institute, FairTax.org, and Kotlikoff criticized the President's Advisory Panel's study as having allegedly altered the terms of the FairTax, using unsound methodology, and/or failing to fully explain their calculations.

[11] The Beacon Hill Institute reported that the FairTax would make the federal tax system more progressive and would benefit the average individual in almost all expenditures deciles.

[7] A study by the Beacon Hill Institute reported that the FairTax may have a negative effect on the well-being of mid-income earners for several years after implementation.

[60] An analysis in 2008 by the Baker Institute For Public Policy indicated that the plan would generate significant overall macroeconomic improvement in both the short and long-term, but warned of transitional issues.

[52] FairTax proponents argue that the proposal would provide tax burden visibility and reduce compliance and efficiency costs by 90%, returning a large share of money to the productive economy.

[61] Bill Archer, former head of the House Ways and Means Committee, asked Princeton University Econometrics to survey 500 European and Asian companies regarding the effect on their business decisions if the United States enacted the FairTax.

[65] The Wall Street Journal columnist James Taranto states the FairTax is unsuited to take advantage of supply-side effects and would create a powerful disincentive to spend money.

[66] Buckley also argues that if the tax rate was significantly higher, the FairTax would discourage the consumption of new goods and hurt economic growth.

The bill would maintain the IRS for three years after implementation before completely decommissioning the agency, providing employees time to find other employment.

An analysis in 2008 by the Baker Institute For Public Policy concluded that the FairTax would have significant transitional issues for the housing sector since the investment would no longer be tax-favored.

[30][38][77] Non-accommodation of the money supply would suggest retail prices and take home pay stay the same—embedded taxes are replaced by the FairTax.

To ease the transition, U.S. retailers will receive a tax credit equal to the FairTax on their inventory to allow for quick cost reduction.

Retailers would also receive an administrative fee equal to the greater of $200 or 0.25% of the remitted tax as compensation for compliance costs,[78] which amounts to around $5 billion.

[53] The Government Accountability Office (GAO), among others, have specifically identified the negative relationship between compliance costs and the number of focal points for collection.

[12] Proponents believe that states that choose to conform to the federal tax base would have advantages in enforcement, information sharing, and clear interstate revenue allocation rules.

[38] Opponents also raise concerns of legal tax avoidance by spending and consuming outside of the U.S. (imported goods would be subject to collection by the U.S. Customs and Border Protection).

"[90] University of Virginia School of Law professor George Yin states that the FairTax could have evasion issues with export and import transactions.

), which would create a paper trail for evasion with risk of having the buyer turn them in (the FairTax authorizes a reward for reporting tax cheats).

[41] Advocates state the significant 86% reduction in collection points would greatly increase the likelihood of business audits, making tax evasion behavior much more risky.

[53] Additionally, the FairTax legislation has several fines and penalties for non-compliance, and authorizes a mechanism for reporting tax cheats to obtain a reward.