Foreign exchange market

Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends.

Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading.

According to the Bank for International Settlements, the preliminary global results from the 2022 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets Activity show that trading in foreign exchange markets averaged US$7.5 trillion per day in April 2022.

[8] Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, pottery, and raw materials.

This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold.

During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants.

[25] At the start of the 20th century, trades in currencies was most active in Paris, New York City and Berlin; Britain remained largely uninvolved until 1914.

[26] During the 1920s, the Kleinwort family were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant FX traders.

However, during the 1930s, London's pursuit of widespread trade prosperity was hindered by continental exchange controls and additional factors in Europe and Latin America.

[31] U.S. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system.

[43] Due to the ultimate ineffectiveness of the Bretton Woods Accord and the European Joint Float, the forex markets were forced to close sometime during 1972 and March 1973.

[48][49][50][51] In developed nations, state control of foreign exchange trading ended in 1973 when complete floating and relatively free market conditions of modern times began.

[53][54] On 1 January 1981, as part of changes beginning during 1978, the People's Bank of China allowed certain domestic "enterprises" to participate in foreign exchange trading.

The levels of access that make up the foreign exchange market are determined by the size of the "line" (the amount of money with which they are trading).

Some multinational corporations (MNCs) can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants.

A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting.

Dealers or market makers, by contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at.

[75] Bureaux de change or currency transfer companies provide low-value foreign exchange services for travelers.

A joint venture of the Chicago Mercantile Exchange and Reuters, called Fxmarketspace opened in 2007 and aspired but failed to the role of a central market clearing mechanism.

These are caused by changes in gross domestic product (GDP) growth, inflation (purchasing power parity theory), interest rates (interest rate parity, Domestic Fisher effect, International Fisher effect), budget and trade deficits or surpluses, large cross-border M&A deals and other macroeconomic conditions.

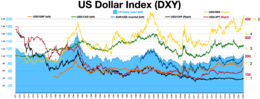

The market convention is to quote most exchange rates against the USD with the US dollar as the base currency (e.g. USDJPY, USDCAD, USDCHF).

Trading in the euro has grown considerably since the currency's creation in January 1999, and how long the foreign exchange market will remain dollar-centered is open to debate.

It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand.

Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect.

Market psychology and trader perceptions influence the foreign exchange market in a variety of ways: A spot transaction is a two-day delivery transaction (except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business day), as opposed to the futures contracts, which are usually three months.

This trade represents a “direct exchange” between two currencies, has the shortest time frame, involves cash rather than a contract, and interest is not included in the agreed-upon transaction.

For example, in 1992, currency speculation forced Sweden's central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona.

Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit.

[91] In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner.

However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses.