Free market

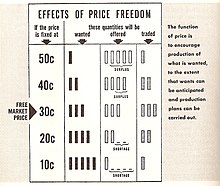

In an idealized free market economy, prices for goods and services are set solely by the bids and offers of the participants.

The degree of competition in markets and the role of intervention and regulation as well as the scope of state ownership vary across different models of capitalism.

Capitalist systems with varying degrees of direct government intervention have since become dominant in the Western world and continue to spread.

It is suggested this would both eliminate the need for regular taxes that have a negative effect on trade (see deadweight loss) as well as release land and resources that are speculated upon or monopolised, two features that improve the competition and free market mechanisms.

Léon Walras, one of the founders of the neoclassical economics who helped formulate the general equilibrium theory, had a very similar view.

[19] The laissez-faire principle expresses a preference for an absence of non-market pressures on prices and wages such as those from discriminatory government taxes, subsidies, tariffs, regulations, or government-granted monopolies.

Advocates of free-market socialism such as Jaroslav Vanek argue that genuinely free markets are not possible under conditions of private ownership of productive property.

Instead, he contends that the class differences and inequalities in income and power that result from private ownership enable the interests of the dominant class to skew the market to their favor, either in the form of monopoly and market power, or by utilizing their wealth and resources to legislate government policies that benefit their specific business interests.

Economists Friedrich Hayek and George Stigler argued that socialism as a theory is not conducive to democratic systems[29] and even the most benevolent state would face serious implementation problems.

This argument holds that democratic majority rule becomes detrimental to enterprises and industries, and that the formation of interest groups distorts the optimal market outcome.

[2] Friedrich Hayek popularized the view that market economies promote spontaneous order which results in a better "allocation of societal resources than any design could achieve".

They further believe that any attempt to implement central planning will result in more disorder, or a less efficient production and distribution of goods and services.

Critics such as political economist Karl Polanyi question whether a spontaneously ordered market can exist, completely free of distortions of political policy, claiming that even the ostensibly freest markets require a state to exercise coercive power in some areas, namely to enforce contracts, govern the formation of labor unions, spell out the rights and obligations of corporations, shape who has standing to bring legal actions and define what constitutes an unacceptable conflict of interest.

Other lesser-known goals are also pursued, such as in the United States, where the federal government subsidizes owners of fertile land to not grow crops in order to prevent the supply curve from further shifting to the right and decreasing the equilibrium price.

Advocates of the free market contend that government intervention hampers economic growth by disrupting the efficient allocation of resources according to supply and demand while critics of the free market contend that government intervention is sometimes necessary to protect a country's economy from better-developed and more influential economies, while providing the stability necessary for wise long-term investment.

[42] Critics of a laissez-faire free market have argued that in real world situations it has proven to be susceptible to the development of price fixing monopolies.

[44] Two prominent Canadian authors argue that government at times has to intervene to ensure competition in large and important industries.

According to Klein and Ralston, the merging of companies into giant corporations or the privatization of government-run industry and national assets often result in monopolies or oligopolies requiring government intervention to force competition and reasonable prices.

[45] Another form of market failure is speculation, where transactions are made to profit from short term fluctuation, rather from the intrinsic value of the companies or products.

This criticism has been challenged by historians such as Lawrence Reed, who argued that monopolies have historically failed to form even in the absence of antitrust law.

Furthermore, according to writer Walter Lippman and economist Milton Friedman, historical analysis of the formation of monopolies reveals that, contrary to popular belief, these were the result not of unfettered market forces, but of legal privileges granted by government.

American philosopher and author Cornel West has derisively termed what he perceives as dogmatic arguments for laissez-faire economic policies as free-market fundamentalism.

West has contended that such mentality "trivializes the concern for public interest" and "makes money-driven, poll-obsessed elected officials deferential to corporate goals of profit – often at the cost of the common good".

"[51] David McNally of the University of Houston argues in the Marxist tradition that the logic of the market inherently produces inequitable outcomes and leads to unequal exchanges, arguing that Adam Smith's moral intent and moral philosophy espousing equal exchange was undermined by the practice of the free market he championed.