Hedge fund

Research in 2015 showed that hedge fund activism can have significant real effects on target firms, including improvements in productivity and efficient reallocation of corporate assets.

[17] Jones referred to his fund as being "hedged", a term then commonly used on Wall Street to describe the management of investment risk due to changes in the financial markets.

[16] During the 1990s, the number of hedge funds increased significantly with the 1990s stock market rise,[15] the aligned-interest compensation structure (i.e., common financial interests), and the promise of above average returns[20] as likely causes.

Dan Loeb called it a "hedge fund killing field" due to the classic long/short falling out of favor because of unprecedented easing by central banks.

[34] The hedge fund industry today has reached a state of maturity that is consolidating around the larger, more established firms such as Citadel, Elliot, Millennium, Bridgewater, and others.

[36] Hedge fund strategies are generally classified among four major categories: global macro, directional, event-driven, and relative value (arbitrage).

The risk element arises from the possibility that the merger or acquisition will not go ahead as planned; hedge fund managers will use research and analysis to determine if the event will take place.

To take advantage of special situations the hedge fund manager must identify an upcoming event that will increase or decrease the value of the company's equity and equity-related instruments.

Hedge fund managers can use various types of analysis to identify price discrepancies in securities, including mathematical, technical, or fundamental techniques.

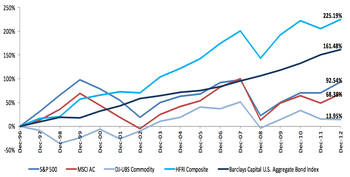

[84] Managers of hedge funds often aim to produce returns that are relatively uncorrelated with market indices and are consistent with investors' desired level of risk.

[99] Many investment funds use leverage, the practice of borrowing money, trading on margin, or using derivatives to obtain market exposure in excess of that provided by investors' capital.

[125] The judge also wrote: "In addition to exposing Morgan Stanley to government investigations and direct financial losses, Skowron's behavior damaged the firm's reputation, a valuable corporate asset.

[134] The prime broker acts as a counterparty to derivative contracts, and lends securities for particular investment strategies, such as long/short equities and convertible bond arbitrage.

[158] US tax-exempt investors (such as pension plans and endowments) invest primarily in offshore hedge funds to preserve their tax exempt status and avoid unrelated business taxable income.

The hedge funds would then execute trades – many of them a few seconds in duration – but wait until just after a year had passed to exercise the options, allowing them to report the profits at a lower long-term capital gains tax rate.The US Senate Permanent Subcommittee on Investigations chaired by Carl Levin issued a 2014 report that found that from 1998 and 2013, hedge funds avoided billions of dollars in taxes by using basket options.

[163] Renaissance argued that basket options were "extremely important because they gave the hedge fund the ability to increase its returns by borrowing more and to protect against model and programming failures".

Side pockets allowed fund managers to lay away illiquid securities until market liquidity improved, a move that could reduce losses.

[192] According to a report by the International Organization of Securities Commissions, the most common form of regulation pertains to restrictions on financial advisers and hedge fund managers in an effort to minimize client fraud.

The Act also exempted hedge funds from mandatory registration with the SEC[70][204][205] when selling to accredited investors with a minimum of US$5 million in investment assets.

[197] The U.S.'s Dodd-Frank Wall Street Reform Act was passed in July 2010[4][94] and requires SEC registration of advisers who manage private funds with more than US$150 million in assets.

[217] The Act requires hedge funds to provide information about their trades and portfolios to regulators including the newly created Financial Stability Oversight Council.

[94] An aspect of AIFMD which challenges established practices in the hedge funds sector is the potential restriction of remuneration through bonus deferrals and clawback provisions.

[253] An August 2012 survey by the Financial Services Authority concluded that risks were limited and had reduced as a result, inter alia, of larger margins being required by counterparty banks, but might change rapidly according to market conditions.

[259] In the mid-2000s, Kirk Wright of International Management Associates was accused of mail fraud and other securities violations[260][261] which allegedly defrauded clients of close to US$180 million.

[262] In December 2008, Bernard Madoff was arrested for running a US$50 billion Ponzi scheme[263] that closely resembled a hedge fund and was incorrectly[264] described as one.

[268] The process of matching hedge funds to investors has traditionally been fairly opaque, with investments often driven by personal connections or recommendations of portfolio managers.

[273] In June 2006, prompted by a letter from Gary J. Aguirre, the U.S. Senate Judiciary Committee began an investigation into the links between hedge funds and independent analysts.

Aguirre was fired from his job with the SEC when, as lead investigator of insider trading allegations against Pequot Capital Management, he tried to interview John Mack, then being considered for chief executive officer at Morgan Stanley.

[277] The systemic practice of hedge funds submitting periodic electronic questionnaires to stock analysts as a part of market research was reported by The New York Times in July 2012.

According to the report, one motivation for the questionnaires was to obtain subjective information not available to the public and possible early notice of trading recommendations that could produce short-term market movements.