History of banking

[citation needed] Many scholars trace the historical roots of the modern banking system to medieval and Renaissance Italy, particularly the affluent cities of Florence, Venice and Genoa.

[38][39][37] Cuneiform records of the house of Egibi of Babylonia describe the family's financial activities as having occurred sometime after 1000 BCE and ending sometime during the reign of Darius I.

Later during the Maurya dynasty (321–185 BCE), an instrument called adesha was in use, which was an order on a banker desiring him to pay the money of the note to a third person, which corresponds to the definition of a bill of exchange as we understand it today.

During the rule of the Greek Ptolemies, the granaries were transformed into a network of banks centered in Alexandria, where the main accounts from all of the Egyptian regional grain-banks were recorded.

Xenophon is credited to have made the first suggestion of the creation of an organisation known in the modern definition as a joint-stock bank in On Revenues written c. 353 BCE[69][70][71][72] The city-states of Greece after the Persian Wars produced a government and culture sufficiently organized for the birth of a private citizenship and therefore an embryonic capitalist society, allowing for the separation of wealth from exclusive state ownership to the possibility of ownership by the individual.

[86][87][88] Before the destruction by Persians during the 480 invasion, the Athenian Acropolis temple dedicated to Athena stored money; Pericles rebuilt a depository afterward contained within the Parthenon.

With the decrease in economic activity after the fall of Rome and Islamic invasions, banking likely temporarily ended in Europe and was not revived until Mediterranean trade commenced again in the 12th century.

The rise of Protestantism in the 16th century weakened Rome's influence, and its dictates against usury became irrelevant in some areas, freeing up the development of banking in Northern Europe.

In the late 18th century, Protestant merchant families began to move into banking to an increasing degree, especially in trading countries such as the United Kingdom (Barings), Germany (Schroders, Berenbergs) and the Netherlands (Hope & Co., Gülcher & Mulder).

As Lombardy merchants and bankers grew in wealth and credit based on the strength of the Lombard plains cereal crops, many displaced Jews fleeing Spanish persecution were attracted to the trade.

They took in local currency and issued demand notes redeemable at any of their castles across Europe, allowing movement of money without the usual risk of robbery while traveling.

[133] Later in the Middle Ages, a distinction evolved between consumable necessities such as food and fuel versus durable goods, with usury permitted on loans that involved the latter.

By the later Middle Ages, Christian merchants who lent money with interest gained ecclesiastical sanction, and Jews lost their privileged position as money-lenders.

[140][141][142] Halil Inalcik suggests that, in the 16th century, Marrano Jews (Doña Gracia from the House of Mendes) fleeing from Iberia introduced the techniques of European capitalism, banking and even the mercantilist concept of state economy to the Ottoman Empire.

Court Jews were Jewish bankers or businessmen who lent money and handled the finances of some of the Christian European noble houses, primarily in the 17th and 18th centuries.

At the time, wealthy merchants began to store their gold with the goldsmiths of London, who possessed private vaults and charged a fee for their service.

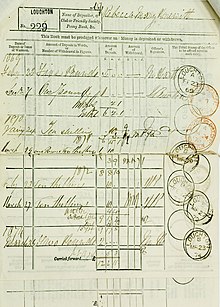

Nevertheless, an Act of Parliament was required in the early 18th century (1704) to overrule court decisions holding that the goldsmiths' notes, despite the "customs of merchants", were not negotiable.

During the Qing dynasty, the private nationwide financial system in China was first developed by the Shanxi merchants, with the creation of so-called "draft banks".

[172][page needed] In the early 18th century, a major experiment in national central banking failed in France with John Law's Banque Royale in 1720–1721.

By the early 21st century, most of the world's countries had a national central bank set up as a public sector institution, albeit with widely varying degrees of independence.

[184] In 1804, Nathan Mayer Rothschild began to deal on the London stock exchange in financial instruments such as foreign bills and government securities.

This private intelligence service enabled Nathan to receive in London the news of Wellington's victory at the Battle of Waterloo a full day ahead of the government's official messengers.

Major businesses directly founded by Rothschild family capital include Alliance Assurance (1824) (now Royal & SunAlliance); Chemin de Fer du Nord (1845); Rio Tinto Group (1873); Société Le Nickel (1880) (now Eramet); and Imétal (1962) (now Imerys).

Its innovations included both private and public sources in funding large projects, and the creation of a network of local offices to reach a much larger pool of depositors.

The origins of the building society as an institution lie in late-18th century Birmingham—a town which was undergoing rapid economic and physical expansion driven by a multiplicity of small metalworking firms, whose many highly skilled and prosperous owners readily invested in property.

[197] Mutual savings banks also emerged at that time, as financial institutions chartered by government, without capital stock, and owned by their members who subscribe to common funds.

The traditional banks had viewed poor and rural communities as unbankable because of very small, seasonal flows of cash and very limited human resources.

In the history of credit unions the concepts of cooperative banking spread through northern Europe and onto the US at the turn of the 20th century under a wide range of different names.

Thus, American corporations and banks started seeking investment opportunities abroad, prompting the development in the U.S. of mutual funds specializing in trading in foreign stock markets.

The main services offered included insurance, pension, mutual, money market and hedge funds, loans and credits and securities.