International use of the U.S. dollar

It claimed this status from sterling after the devastation of two world wars and the massive spending of the United Kingdom's gold reserves.

[1] The U.S. dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.

The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank.

The U.S. dollar began to displace sterling as international reserve currency from the 1920s since it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows.

[4] After the US emerged as an even stronger global superpower during the Second World War, the Bretton Woods Agreement of 1944 established the post-war international monetary system, with the U.S. dollar ascending to become the world's primary reserve currency for international trade, and the only post-war currency linked to gold at $35 per troy ounce.

Central banks worldwide have huge reserves of U.S. dollars in their holdings, and are significant buyers of US treasury bills and notes.

But Samuelson stated in 2005 that at some uncertain future period these pressures would precipitate a run against the U.S. dollar with serious global financial consequences.

Instead the euro's stability and future existence was put into doubt, which reduced its share of global reserves to 19% as of year-end 2015 (vs 66% for USD).

[14][15][16] The U.S. dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.

In contrast, foreign governments and corporations incapable of raising money in their own local currencies are forced to issue debt denominated in U.S. dollars, along with its consequent higher interest rates and risks of default.

[17] The United States's ability to borrow in its own currency without facing significant balance of payments crisis has been frequently described as its exorbitant privilege.

[18] The U.S. dollar Index (ticker: USDX) is the creation of the New York Board of Trade (NYBOT), renamed in September 2007 to ICE Futures US.

It was established in 1973 for tracking the value of the USD against a basket of currencies, which, at that time, represented the largest trading partners of the United States.

This event marks the watershed between the wider margins arrangement of the Smithsonian regime and the period of generalized floating that led up to the Second Amendment of the Articles of Agreement of the International Monetary Fund.

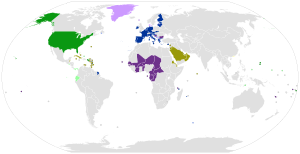

In Lebanon, one dollar is equal to 15000 Lebanese pounds, and is used interchangeably with local currency as de facto legal tender.

[26] In some countries, such as Costa Rica and Honduras, the U.S. dollar is commonly accepted, although not officially regarded as legal tender.

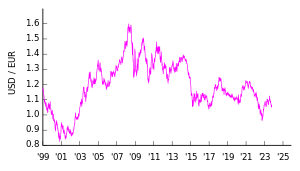

The fallout from the subprime mortgage crisis in 2008 prompted the Federal Reserve to lower interest rates in September 2007,[30] and again in March 2008,[31] sending the euro to a record high of $1.6038, reached in July 2008.

[32] In addition to the trade deficit, the U.S. dollar's decline was linked to a variety of other factors, including a major spike in oil prices.

Tencent priced $5 billion of notes in January 2018 as a string of Asian technology firms continued to issue debt as market values swelled.