Long Depression

[1] It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War.

[11] In 1873, during a decline in the value of silver – exacerbated by the end of the German Empire's production of thaler coins – the US government passed the Coinage Act of 1873 in April.

This measure, referred to by its opponents as "the Crime of 1873" and the topic of William Jennings Bryan's Cross of Gold speech in 1896, forced a contraction of the money supply in the United States.

[13] [page needed] The optimism that had been driving booming stock prices in central Europe had reached a fever pitch, and fears of a bubble culminated in a panic in Vienna beginning in April 1873.

[13][page needed] Financial panic arrived in the Americas only months later on Black Thursday, September 18, 1873, after the failure of the banking house of Jay Cooke and Company over the Northern Pacific Railway.

In the US the speculative nature of financing due to both the greenback, which was paper currency issued to pay for the Civil War and rampant fraud in the building of the Union Pacific Railway up to 1869 culminated in the Crédit Mobilier scandal.

The US Coinage Act of 1873 was met with great opposition by farmers and miners, as silver was seen as more of a monetary benefit to rural areas than to banks in big cities.

In addition, there were US citizens who advocated the continuance of government-issued fiat money (United States Notes) to avoid deflation and promote exports.

[26] The financial crisis was compounded by diseases impacting the wine and silk industries[25] French capital accumulation and foreign investment plummeted to the lowest levels experienced by France in the latter half of the 19th century.

[29] The United Kingdom, which had previously experienced crises every decade since the 1820s, was initially less affected by this financial crisis, even though the Bank of England kept interest rates as high as 9 percent in the 1870s.

[13] The 1878 failure of the City of Glasgow Bank in Scotland arose through a combination of fraud and speculative investments in Australian and New Zealand companies (agriculture and mining) and in American railroads.

[30] After absorbing as much as 20% of US capital investment in the years preceding the crash, this expansion came to a dramatic end in 1873; between 1873 and 1878, the total amount of railroad mileage in the United States barely increased at all.

Chartered in 1865 in the aftermath of the American Civil War, the bank had been established to advance the economic welfare of America's newly emancipated freedmen.

[37] In the early 1870s, the bank had joined in the speculative fever, investing in real estate and unsecured loans to railroads; its collapse in 1874 was a severe blow to African-Americans.

[30] Construction began recovery by 1879; the value of building permits increased two and a half times between 1878 and 1883, and unemployment fell to 2.5% in spite of (or perhaps facilitated by) high immigration.

[26] The decline became a brief financial crisis in 1884, when multiple New York banks collapsed; simultaneously, in 1883–1884, tens of millions of dollars of foreign-owned American securities were sold out of fears that the United States was preparing to abandon the gold standard.

[43] As a result of the protectionist policies enacted by the world's major trading nations, the global merchant marine fleet posted no significant growth from 1870 to 1890 before it nearly doubled in tonnage in the prewar economic boom that followed.

[42] In 1874, a year after the 1873 crash, the United States Congress passed legislation called the Inflation Bill of 1874 designed to confront the issue of falling prices by injecting fresh greenbacks into the money supply.

[45] In 1878, Congress overrode President Rutherford B. Hayes's veto to pass the Silver Purchase Act, a similar but more successful attempt to promote "easy money".

[30] This led to widespread unrest and often violence in many major cities and industrial hubs including Baltimore, Philadelphia, Pittsburgh, Reading, Saint Louis, Scranton, and Shamokin.

[46] The Long Depression arguably contributed to the revival of colonialism leading to the New Imperialism period, symbolized by the scramble for Africa, as the western powers sought new markets for their surplus accumulated capital.

[48] In the United States, beginning in 1878, the rebuilding, extending, and refinancing of the western railways, commensurate with the wholesale giveaway of water, timber, fish, minerals in what had previously been Indian territory, characterized a rising market.

And yet the world wonders, and commissions of great states inquire, without coming to definite conclusions, why trade and industry in recent years has been universally and abnormally disturbed and depressed.Wells notes that many of the government inquiries on the "depression of prices" (deflation) found various reasons such as the scarcity of gold and silver.

Nobel laureate economist Milton Friedman, author of A Monetary History of the United States, on the other hand, blamed this prolonged economic crisis on the imposition of a new gold standard, part of which he referred to by its traditional name, The Crime of 1873.

[56] This forced shift into a currency whose supply was limited by nature, unable to expand with demand, caused a series of economic and monetary contractions that plagued the entire period of the Long Depression.

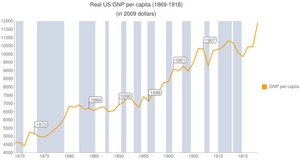

Murray Rothbard, in his book History of Money and Banking of the United States, argues that the long depression was only a misunderstood recession since real wages and production were actually increasing throughout the period.

Studies of other countries where prices also tumbled, including the United States, Germany, France, and Italy, reported more markedly positive trends in both nominal and real per capita income figures.

Furthermore, some economists argue a falling general price level is not inherently harmful to an economy and cite the economic growth of the period as evidence.

[58]Accompanying the overall growth in real prosperity was a marked shift in consumption from necessities to luxuries: by 1885, "more houses were being built, twice as much tea was being consumed, and even the working classes were eating imported meat, oranges, and dairy produce in quantities unprecedented".

Prices certainly fell, but almost every other index of economic activity – output of coal and pig iron, tonnage of ships built, consumption of raw wool and cotton, import and export figures, shipping entries and clearances, railway freight clearances, joint-stock company formations, trading profits, consumption per head of wheat, meat, tea, beer, and tobacco – all of these showed an upward trend.