Mining industry of China

As of 2022[update], more than 200 types of minerals are actively explored or mined in the People's Republic of China (PRC).

The industry was opened to private enterprises during the Chinese economic reform in the 1980s and became increasingly marketized in the 1990s.

In the mid-2000s, the Chinese government sought to consolidate the industry due to concerns about underutilization of resources, workplace safety, and environmental harm.

[1]: 39 Beginning in 1902, the Qing dynasty attempted to regulate and limit foreign control of mining rights in its borders.

[1]: 39 During the 1980s as part of the Chinese economic reform under Deng Xiaoping, the central government encouraged private exploration and mineral use under the policy of "speeding up the water flow".

[1]: 40–41 This approach was driven by concern over environmental harm, workplace safety, and inefficient utilization of mineral deposits.

[1]: 38 In 2017, mining industry profits again increased, having previously dropped after the early 2000s "golden decade".

[3]: 218 As part of its efforts to enhance the circular economy, China is attempting to decrease its reliance on mining for its mineral supply.

[1]: 54 For example, since 2004, some local governments in Shanxi province have required that coal mining companies set aside funds for investing in noncoal business like agriculture and produce processing.

[1]: 54–55 In 2022, according to the United States Geological Survey, China accounted for 54.5% of total antimony production, followed by Russia with 18.2% and Tajikistan with 15.5%.

[1]: 21 It exists in almost all Chinese provinces although major coal mining sites are largely located in northern and central China.

[8]: 70 Major coal-producing regions like Shaanxi, Inner Mongolia, and Shanxi instituted administrative caps on coal output.

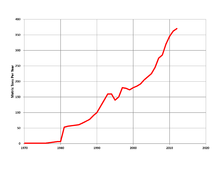

[3]: 187 Beginning in 2003 and continuing through at least 2024, China has been the world's largest importer of iron ore.[3]: 23 Its domestic production peaked in 2007 at 402 million tonnes.

[3]: 102 China's domestic iron ore sector is highly fragmented among a large number of companies.

[3]: 31 In 2009, the Chinese government named China Iron and Steel Association (CISA) the new negotiator.

[3]: 109 The benchmark pricing system for iron ore ended in 2010 and was replaced with a spot market.

[3]: 117–118 In 2014, the CBMX platform was transferred to a Chinese and foreign joint venture (the Beijing Iron Ore Trading Center Corporation, or COREX) and ownership was broadened to include trading houses and the four largest Chinese steel mills, in addition to CISA.

[3]: 143 China's domestic potash production comes from isolated mining sites located inland.

[3]: 157 Most potash deposits in China are concentrated in the deserts and salt flats of the endorheic basins of its western provinces, particularly Qinghai.

Geological expeditions discovered the reserves in the 1950s[13] but commercial exploitation lagged until China's Reform and Opening Up.

[14] The domestic potash production industry is heavily consolidated, with 21 mining companies operating in China (19 in Qinghai and 2 in Xinjiang Autonomous Region).

[3]: 197 China's poor uranium resources have resulted in the country developing a strong foreign procurement strategy.

[3]: 188 China's uranium procurement approach includes investment in foreign mining operations.