Mortgage-backed security

The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.

The total face value of an MBS decreases over time, because like mortgages, and unlike bonds, and most other fixed-income securities, the principal in an MBS is not paid back as a single payment to the bond holder at maturity but rather is paid along with the interest in each periodic payment (monthly, quarterly, etc.).

These securitization trusts may be structured by government-sponsored enterprises as well as by private entities that may offer credit enhancement features to mitigate the risk of prepayment and default associated with these mortgages.

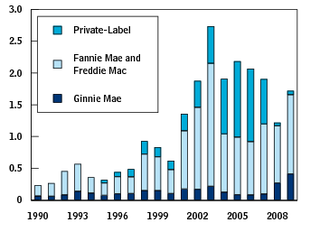

In the United States, the most common securitization trusts are sponsored by Fannie Mae and Freddie Mac, US government-sponsored enterprises.

Ginnie Mae, a US government-sponsored enterprise backed by the full faith and credit of the US government, guarantees that its investors receive timely payments but buys limited numbers of mortgage notes.

[6][7] Issuances of private-label mortgage-backed securities increased dramatically from 2001 to 2007 and then ended abruptly in 2008, when real estate markets began to falter.

Unlike the traditional localized, inefficient mortgage market where there might be a shortage or surplus of funds at any one time, MBSs were national and international in scope and regionally diversified.

[10] Mortgage-backed securities helped move interest rates out of the banking sector and facilitated greater specialization among financial institutions.

However, mortgage-backed securities may have "led inexorably to the rise of the subprime industry" and "created hidden, systemic risks".

Historically, "less than 2% of people lost their homes to foreclosure", but with securitization, "once a lender sold a mortgage, it no longer had a stake in whether the borrower could make his or her payments.

Even though the fixed-rate mortgage did not yet exist at this time, the law deemed it illegal for a banking institution to both sponsor debts and design investment vehicles or market-making tools as the selfsame entity.

[23] In 1983 the Federal Reserve Board amended Regulation T to allow broker-dealers to use pass-throughs as margin collateral, equivalent to over-the-counter non-convertible bonds.

[30] It was signed into law in 1999 by President Clinton, and allowed sole, in-house creation (by solitary banking institutions) of Mortgage-Backed Securities as investment and derivatives instruments.

This legislative decision did not just tweak or finesse the preexisting law, it effectively repealed the Glass-Steagall Act of 1933, the only remaining statutory safeguard poised against the ensuing disaster.

To distinguish the basic MBS bond from other mortgage-backed instruments, the qualifier pass-through is used, in the same way that "vanilla" designates an option with no special features.

Alt-A mortgages are an ill-defined category, generally prime borrowers but non-conforming in some way, often lower documentation (or in some other way: vacation home, etc.

[citation needed] Reasons (other than investment or speculation) for entering the market include the desire to hedge against a drop in prepayment rates (a critical business risk for any company specializing in refinancing).

As of 2021, the volume of mortgage-backed securities (MBS) outstanding in the United States has surpassed 12 trillion U.S. dollars, marking a significant growth in the market size.

This expansion reflects the increasing role of MBS in the financing of residential real estate, demonstrating the importance of these securities in the overall financial system and housing market.

[40] Since these two sources of risk (IR and prepayment) are linked, solving mathematical models of MBS value is a difficult problem in finance.

Prepayment is classified as a risk for the MBS investor despite the fact that they receive the money, because it tends to occur when floating rates drop and the fixed income of the bond would be more valuable (negative convexity).

Given the market price, the model produces an option-adjusted spread, a valuation metric that takes into account the risks inherent in these complex securities.

Typically, high-premium (high-coupon) MBSs backed by mortgages with an original loan balance no larger than $85,000 command the largest pay-ups.

Even though the borrower is paying an above market yield, he or she is dissuaded from refinancing a small loan balance due to the high fixed cost involved.

Practitioners constantly try to improve prepayment models and hope to measure values for input variables implied by the market.

The legitimacy and overall accuracy of this alternative recording system have faced serious challenges with the onset of the mortgage crisis: as the US courts flood with foreclosure cases, the inadequacies of the MERS model are being exposed, and both local and federal governments have begun to take action through suits of their own and the refusal (in some jurisdictions) of the courts to recognize the legal authority of MERS assignments.

[44][45] The assignment of mortgage (deed of trust) and note (obligation to pay the debt) paperwork outside of the traditional US county courts (and without recordation fee payment) is subject to legal challenge.

Legal inconsistencies in MERS originally appeared trivial, but they may reflect dysfunctionality in the entire US mortgage securitization industry.