Mortgage

The lender will typically be a financial institution, such as a bank, credit union or building society, depending on the country concerned, and the loan arrangements can be made either directly or indirectly through intermediaries.

As with other types of loans, mortgages have an interest rate and are scheduled to amortize over a set period of time, typically 30 years in the United States.

All types of real property can be, and usually are, secured with a mortgage and bear an interest rate that is supposed to reflect the lender's risk.

The most basic arrangement would require a fixed monthly payment over a period of ten to thirty years, depending on local conditions.

Lenders may also, in many countries, sell the mortgage loan to other parties who are interested in receiving the stream of cash payments from the borrower, often in the form of a security (by means of a securitization).

Mortgage lending will also take into account the (perceived) riskiness of the mortgage loan, that is, the likelihood that the funds will be repaid (usually considered a function of the creditworthiness of the borrower); that if they are not repaid, the lender will be able to foreclose on the real estate assets; and the financial, interest rate risk and time delays that may be involved in certain circumstances.

The mortgage origination and underwriting process involves checking credit scores, debt-to-income, downpayments (deposits), assets, and assessing property value.

The first implies that income tax paid by individual taxpayers will be refunded to the extent of interest on mortgage loans taken to acquire residential property.

In other words, the borrower may be required to show the availability of enough assets to pay for the housing costs (including mortgage, taxes, etc.)

Many countries have a notion of standard or conforming mortgages that define a perceived acceptable level of risk, which may be formal or informal, and may be reinforced by laws, government intervention, or market practice.

In the United States, a conforming mortgage is one which meets the established rules and procedures of the two major government-sponsored entities in the housing finance market (including some legal requirements).

A mortgage is a form of annuity (from the perspective of the lender), and the calculation of the periodic payments is based on the time value of money formulas.

With this arrangement regular contributions are made to a separate investment plan designed to build up a lump sum to repay the mortgage at maturity.

Moving forward, the FSA under the Mortgage Market Review (MMR) have stated there must be strict criteria on the repayment vehicle being used.

Buydown mortgages allow the seller or lender to pay something similar to points to reduce interest rate and encourage buyers.

In virtually all jurisdictions, specific procedures for foreclosure and sale of the mortgaged property apply, and may be tightly regulated by the relevant government.

The German Bausparkassen (savings and loans associations) reported nominal interest rates of approximately 6 per cent per annum in the last 40 years (as of 2004).

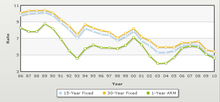

However, in the United States, the average interest rates for fixed-rate mortgages in the housing market started in the tens and twenties in the 1980s and have (as of 2004) reached about 6 per cent per annum.

[18] In April 2014, the Office of the Superintendent of Financial Institutions (OSFI) released guidelines for mortgage insurance providers aimed at tightening standards around underwriting and risk management.

In a statement, the OSFI has stated that the guideline will "provide clarity about best practices in respect of residential mortgage insurance underwriting, which contribute to a stable financial system."

This comes after several years of federal government scrutiny over the CMHC, with former Finance Minister Jim Flaherty musing publicly as far back as 2012 about privatizing the Crown corporation.

[19] In an attempt to cool down the real estate prices in Canada, Ottawa introduced a mortgage stress test effective 17 October 2016.

Because of all the criticisms from real estate industry, Canada finance minister Bill Morneau ordered to review and consider changes to the mortgage stress test in December 2019.

The major lenders include building societies, banks, specialized mortgage corporations, insurance companies, and pension funds.

[25][26] This is in part because mortgage loan financing relies less on fixed income securitized assets (such as mortgage-backed securities) than in the United States, Denmark, and Germany, and more on retail savings deposits like Australia and Spain.

For Islamic home financing, it follows the Sharia Law and comes in 2 common types: Bai’ Bithaman Ajil (BBA) or Musharakah Mutanaqisah (MM).

[39] However, real estate is far too expensive for most people to buy outright using cash: Islamic mortgages solve this problem by having the property change hands twice.

In the United Kingdom, the dual application of stamp duty in such transactions was removed in the Finance Act 2003 in order to facilitate Islamic mortgages.

In the last case, mortgage insurance can be dropped when the lender informs the borrower, or its subsequent assigns, that the property has appreciated, the loan has been paid down, or any combination of both to relegate the loan-to-value under 80%.

must resort to selling the property to recoup their original investment (the money lent) and are able to dispose of hard assets (such as real estate) more quickly by reductions in price.

The final cost will be exactly the same: * when the interest rate is 2.5% and the term is 30 years than when the interest rate is 5% and the term is 15 years * when the interest rate is 5% and the term is 30 years than when the interest rate is 10% and the term is 15 years