Negative gearing in Australia

[citation needed] Negative gearing continues to be a controversial political issue in Australia and was a major issue during the 2016 and 2019 Australian federal elections, during which the Australian Labor Party proposed restricting but not eliminating negative gearing and to halve the capital gains tax discount to 25%.

[2] An analysis found that negative gearing in Australia provides a greater benefit to wealthier Australians than the less wealthy according to a report from the Grattan Institute.

This was unsupported by evidence other than localised increases in real rents in both Perth and Sydney, which also had the lowest vacancy rates of all capital cities at the time.

On the other hand, in some contexts, the investment losses are ignored, such as in the case of determining the thresholds for the Medicare levy surcharge, the private health insurance rebate, and in calculating the HELP Repayment Income, as well as other Centrelink income-tested allowances and benefits.

In fact, if you dig into other parts of the REI database, what you find is that vacancy rates were unusually low at that time before negative gearing was abolished.

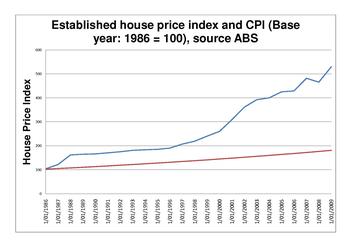

But the fact is that when we observe the results, resources and finance are being disproportionately channelled into this area, and property promoters use tax effectiveness as an important selling point.

"[11] A 2015 report from the Senate Economics References Committee argues that, while negative gearing influences housing affordability, the primary issue is a mismatch between supply and demand.

[2] An analysis found that negative gearing in Australia provides a greater benefit to wealthier Australians than the less wealthy.