Oliver Wyman

Founded in New York City in 1984 by former Booz Allen Hamilton partners Alex Oliver and Bill Wyman, the firm has more than 60 offices in Europe, North America, the Middle East, and Asia-Pacific employing over 5,000 professionals.

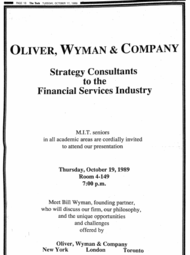

Two of the founders, Alexander Oliver and William (Bill) Wyman, both partners at Booz wanted to create a company that would specialize and excel at consulting a certain industry at a time when most other firms were trying to become generalists.

"[6] In 2008, Harvard Business School published a case documenting how the acquisitions were restructured and rebranded to create a preeminent firm based on specialization and industry expertise.

[19] In a candid interview with The Christian Science Monitor, Carl Sloane said "In the 1960s, if you had a Harvard MBA, a blue serge suit, and an air travel card, you were a consultant."

[25][26] In 1971, the chairman of the firm's board gave an expert testimony analyzing the impacts of the Energy Policy and Conservation Act based on Temple, Barker & Sloane's experience in the marine transportation industry.

[30] Unlike many of his peers, Lewis had never gone to business school, opting instead to start his own firm building computerized models for clients such as Ameritech Corporation (which would later become AT&T), Chase Bank, General Electric, and Royal Dutch Shell.

[42] Temple, Barker & Sloane (TBS) was merged with Strategic Planning Associates (SPA) to form "Mercer Management Consulting" in 1990, a business unit specializing in risk and financial services.

[43] The two firms had markedly different cultures, with TBS focusing on industry-specific expertise-based consulting,[44] while SPA applied data-based models to a broad range of industries.

[62] Mercer's strengths at the time were in transport, insurance, asset management, and retail broking; while Oliver, Wyman & Company's were in capital markets and investment banking.

It is a strategy that saved it from implosion during the dot.com debacle and enabled it to grow as demand from financial clients recovered.In the years after, Mercer Oliver Wyman experienced rapid growth up to 25% annually, and was the fastest-growing consultancy in the top 10.

[70][71] From 2013 to 2019, Oliver Wyman Group grew at an average rate of 7% per year, outperforming the growth of the global management consulting market,[72] despite experiencing a drop in revenue after Brexit.

[74] The firm undertakes a variety of notable projects in the automotive, defense, education, energy, healthcare, telecommunications, transportation, and travel industries, but is particularly distinguished in the financial services sector.

[79][80] Reportedly, Mercer Oliver Wyman was the unnamed consulting firm that recommended Citigroup expand parts of their fixed income business in 2005, including in collateralised debt obligations, which led to more than $50 billion in losses during the global financial crisis and ultimately necessitated a rescue by the U.S.

[83] A year later, on March 17, 2008, the Irish stock market plunged as investors globally dumped shares in fear of the United States subprime mortgage crisis.

It would not have been a good idea to invest in Anglo Irish... We also unfortunately did not forecast the financial crisis in 2006.”[88] The event damaged Oliver Wyman's reputation in Ireland, with future assignments coming under heavy scrutiny.

[96] In 2012, Oliver Wyman was hired by the British Bankers' Association to provide technical assistance in reviewing how the rate was set after a preliminary investigation uncovered significant fraud and collusion among banks.

The unique arrangement allowed Oliver Wyman to bypass traditional barriers to entry in the Middle East, such as a shortage of Arabic speakers, and establish long-term work availability.

[104] In 2018, the group was hired to advise on an initial public offering of the $90 billion Kuwaiti stock market, a process which had been held up for years due to political infighting in the country.

[107][108] In 2015, partners from Oliver Wyman met with representatives from major South African institutions, including Eskom, Transnet, and the Department of Cooperative Governance.

Oliver Wyman's final report found that the fee structure was "very unusual", raised multiple concerns regarding billing, and advised the company to take legal action against McKinsey and Trillian.

[114] After receiving the report, Eskom made false statements to the South African newspaper Business Day about its conclusions, claiming that Oliver Wyman found that all payments were fair.

A representative from the Democratic Alliance party ultimately required Eskom to give Oliver Wyman's report to the South African Parliament for verification.

[119] In 2017, McKinsey issued an apology for making “several errors in judgment” and in 2018, the firm acknowledged that it had overcharged in what The Financial Times described as "South Africa’s biggest ever corruption scandal.

[122] Over 2,300 pages of project planning were leaked and published by The Wall Street Journal in 2019, revealing that the consultancies had made recommendations which relied on technology that did not yet exist such as flying taxis, robot maids, and an artificial moon.

[125] The case brought light to potential human rights abuses involved in the creation of the city, with the firms making recommendations on how to forcibly relocate indigenous Howeitat tribes,[126] develop a 24/7 surveillance system using facial recognition technology, and enforce Sharia law.

Two voted to appoint Oliver Wyman to conduct the tests, while the other, former chairman of the Australian Competition & Consumer Commission Graeme Samuel, strongly opposed.

By majority vote, Oliver Wyman was hired for an undisclosed sum in the millions to conduct the tests, and ARPA stated that their final report was "valuable".