Omaha Reservation

By this treaty, the Omaha Nation sold the majority of its land west of the Missouri River to the United States, but was authorized to select an area of 300,000 acres (470 sq mi; 1,200 km2) to keep as a permanent reservation.

[8][9] The Omahas later conveyed an additional 12,348 acres of timber land to the Winnebago Reservation through an act of Congress on June 22, 1874, and a deed dated July 31, 1874.

[11] Through the lobbying efforts of anthropologist Alice Cunningham Fletcher, Congress passed another act on August 7, 1882, that divided the eastern portion of the reservation into individual allotments for Omaha tribal members, while authorizing the sale of land west of the Sioux City and Nebraska Railroad to settlers and speculators.

[13] An additional act on March 3, 1893, allotted most of the remaining Omaha tribal land to individual women and children who had been left out of the 1882 legislation.

In the late nineteenth century, Congress authorized sales of land to non-Omaha in the western portion of the reservation, where European-American farmers had settled.

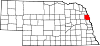

[18] The Omaha Tribe contends that Pender is within tribal jurisdiction, as Congress did not change the boundaries of reservation, which includes most of Thurston County.

"[19] Asked for its opinion on a related matter related to the Omaha Tribe's law that liquor merchants on the reservation had to pay tribal license fees and sales taxes (see section below), the Nebraska state attorney general noted its opinion, based on Congressional laws and a field ruling during the Ronald Reagan administration, that Pender was outside the reservation boundaries.

[18] On March 22, 2016, the United States Supreme Court held, in a unanimous decision, that Pender is within the reservation's boundaries.

[21] In December 2006, the Omaha Tribe issued notices to the seven liquor stores in Pender (which has a population of 1,000), as well as those in Rosalie and Walthill, Nebraska, informing them that as of January 1, 2007, the merchants would have to pay the Omaha Tribe liquor licensing fees and a 10 percent sales tax to continue to operate within the reservation.

Ben Thompson, an Omaha attorney who represents the tribe, notes that it has the legal right to establish such laws within the reservation.

While the case was pending, the judge ordered a temporary stay on the merchants' paying the liquor sales tax.