Petroleum industry in Iran

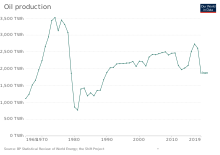

The oil and gas industry has been the engine of economic growth, directly affecting public development projects, the government's annual budget, and most foreign exchange sources.

By purchasing a majority of the company's shares in 1914, the British government gained direct control of the Iranian oil industry, which it would not relinquish for 37 years.

A 1953 coup d'état led by British and U.S. intelligence agencies ousted the Mosaddeq government and paved the way for a new oil agreement.

[14][15] In 1954, a new agreement divided profits equally between the NIOC and a multinational consortium that had replaced the AIOC, which at this time had been renamed The British Petroleum Company.

By the time of the Islamic Revolution of 1978–79, the five largest international companies that had agreements with the NIOC accounted for only 10.4 percent of total oil production.

Initially Iran's post-revolutionary oil policy was based on foreign currency requirements and the long-term preservation of the natural resource.

Early in the first administration of President Mohammad Khatami, in office 1997–2005, the government paid special attention to developing Iran's oil and gas industry.

[17] in July 2015, the signing of the JCPOA by Hassan Rouhani and Javad Zarif with Barack Obama heralded a new era of détente in foreign relations.

The withdrawal by Donald Trump from the JCPOA in May 2018 was an ill wind for Iran because he decided to re-apply the sanctions regime that had caused such difficulties to Khamenei.

[23] Chinese foreign ministry spokesperson Geng Shuang "resolutely opposes" American unilateral sanctions.

Market value of Iran's total oil reserves at international crude price of $75 per barrel stands at ~US $10 trillion.

[5][28] In 2009, China National Petroleum Corp (CNPC) signed a deal with the National Iranian Oil Company with CNPC taking ownership of a 70% stake upon promising to pay 90 percent of the development costs for the South Azadegan oil field, with the project needing investment of up to $2.5 billion.

Earlier that year, CNPC also won a $2 billion deal to develop the first phase of the North Azadegan oilfield.

[29] A more modest yet important agreement was signed with India to explore and produce oil and natural gas in southern Iran.

The direction of crude oil exports changed after the Revolution because of the U.S. trade embargo on Iran and the marketing strategy of the NIOC.

Initially, Iran's post-revolutionary crude oil export policy was based on foreign currency requirements and the need for long-term preservation of the natural resource.

[39] According to the Global Energy Monitor website, in 2023, the top five countries in terms of developing pipelines, proposed and under construction, are the United States, India, Iraq, Iran, and Tanzania.

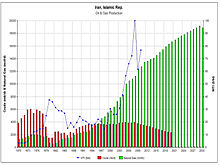

[44] In 2006 annual production reached 105 billion cubic meters, with fastest growth occurring over the previous 15 years.

South Pars, Iran's largest natural gas field, has received substantial foreign investment.

With its output intended for both export and domestic consumption, South Pars is expected to reach full production in 2015.

However, delays and lower production in the Iranian side due to sanctions is resulting in migration of gas to the Qatari part and a loss for Iran.

[50] In the 1980s, Iran began to replace oil, coal, charcoal, and other fossil-fuel energy sources with natural gas, which is environmentally safer.

In 2010, the market value of Iran's total natural gas reserves at a comparative international energy price of $75 per barrel of oil stood at ~US $4 trillion.

[57] Once all pipelines become operational, Iran can potentially export a total of more than 200 million cubic meter of natural gas every year to Iraq, India, Pakistan, and Oman.

In 2005, Iran exported natural gas to Turkey and was expected to expand its market to Armenia, China, Japan, other East Asian countries, India, Pakistan, and Europe.

In spring 2007, the first section of a new line to Armenia opened, as a much-discussed major pipeline to India and Pakistan remained in the negotiation stage.

Under the plan, Turkey would assist in developing Iran's South Pars field in exchange for cash or natural gas.

The goal of this expansion is to increase the percentage of Iran's processed petroleum-based exports, which are more profitable than raw materials.

Receiving 30 percent of Iran's petrochemical exports between them, China and India were the major trading partners in this industry.

[62] Iran's domestic resource base gives it a unique comparative advantage in producing petrochemicals when international crude oil prices rise.