Private equity

In the field of finance, private equity is offered instead to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies.

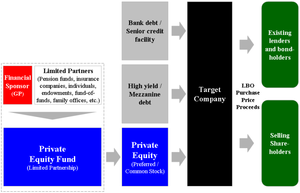

Private equity provides working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control.

[2] As a financial product, the private-equity fund is a type of private capital for financing a long-term investment strategy in an illiquid business enterprise.

[18] As a percentage of the purchase price for a leverage buyout target, the amount of debt used to finance a transaction varies according to the financial condition and history of the acquisition target, market conditions, the willingness of lenders to extend credit (both to the LBO's financial sponsors and the company to be acquired) and the interest costs and the ability of the company to cover those costs.

[30] In compensation for the increased risk, mezzanine debt holders require a higher return for their investment than secured or other more senior lenders.

Venture investment is most often found in the application of new technology, new marketing concepts and new products that do not have a proven track record or stable revenue streams.

Being able to secure financing is critical to any business, whether it is a startup seeking venture capital or a mid-sized firm that needs more cash to grow.

[34][40] Investors generally commit to venture capital funds as part of a wider diversified private-equity portfolio, but also to pursue the larger returns the strategy has the potential to offer.

Secondaries also typically experience a different cash flow profile, diminishing the j-curve effect of investing in new private-equity funds.

The seeds of the US private-equity industry were planted in 1946 with the founding of two venture capital firms: American Research and Development Corporation (ARDC) and J.H.

[61][62][failed verification] It is commonly noted that the first venture-backed startup is Fairchild Semiconductor, which produced the first commercially practicable integrated circuit, funded in 1959 by what would later become Venrock Associates.

These investment vehicles would utilize a number of the same tactics and target the same type of companies as more traditional leveraged buyouts and in many ways could be considered a forerunner of the later private-equity firms.

Among the most notable investors to be labeled corporate raiders in the 1980s included Carl Icahn, Victor Posner, Nelson Peltz, Robert M. Bass, T. Boone Pickens, Harold Clark Simmons, Kirk Kerkorian, Sir James Goldsmith, Saul Steinberg and Asher Edelman.

Many of the major banking players of the day, including Morgan Stanley, Goldman Sachs, Salomon Brothers, and Merrill Lynch were actively involved in advising and financing the parties.

Additionally, the RJR Nabisco deal was showing signs of strain, leading to a recapitalization in 1990 that involved the contribution of $1.7 billion of new equity from KKR.

[81] The combination of decreasing interest rates, loosening lending standards and regulatory changes for publicly traded companies (specifically the Sarbanes–Oxley Act) would set the stage for the largest boom private equity had seen.

[88] Additionally, U.S.-based private-equity firms raised $215.4 billion in investor commitments to 322 funds, surpassing the previous record set in 2000 by 22% and 33% higher than the 2005 fundraising total[89] The following year, despite the onset of turmoil in the credit markets in the summer, saw yet another record year of fundraising with $302 billion of investor commitments to 415 funds[90] Among the mega-buyouts completed during the 2006 to 2007 boom were: EQ Office, HCA,[91] Alliance Boots[92] and TXU.

Starting from 2018 these companies converted from partnerships into corporations with more shareholder rights and the inclusion in stock indices and mutual fund portfolios.

[105] Today pension investment in private equity accounts for more than a third of all monies allocated to the asset class, ahead of other institutional investors such as insurance companies, endowments, and sovereign wealth funds.

Private-equity investment returns are typically realized through one of the following avenues: Large institutional asset owners such as pension funds (with typically long-dated liabilities), insurance companies, sovereign wealth and national reserve funds have a generally low likelihood of facing liquidity shocks in the medium term, and thus can afford the required long holding periods characteristic of private-equity investment.

Increasingly, secondaries are considered a distinct asset class with a cash flow profile that is not correlated with other private-equity investments.

Often private-equity fund managers will employ the services of external fundraising teams known as placement agents in order to raise capital for their vehicles.

Following on from a strong start, deal activity slowed in the second half of 2011 due to concerns over the global economy and sovereign debt crisis in Europe.

An oft-cited academic paper (Kaplan and Schoar, 2005)[118] suggests that the net-of-fees returns to PE funds are roughly comparable to the S&P 500 (or even slightly under).

[120] Commentators have argued that a standard methodology is needed to present an accurate picture of performance, to make individual private-equity funds comparable and so the asset class as a whole can be matched against public markets and other types of investment.

[140][141] While a private equity investment into a business might result in short-term improvements, such as new staff and equipment, the incentive is to maximize profits, not necessarily the quality of products or services.

The main point of contention is that FDI is used solely for production, whereas in the case of private equity the investor can reclaim their money after a revaluation period and make investments in other financial assets.

Researchers at the Becker Friedman Institute of the University of Chicago found that private-equity ownership of nursing homes increased the short-term mortality of Medicare patients by 10%.

[148] Private equity ownership of dermatology practices has led to pressure to increase profitability, concerns about up-charging and patient safety.

[149][150] In a large 2024 study of 51 private equity–acquired hospitals matched with 250 controls, the former had a 25% increase in hospital-acquired conditions, like falls and central line-associated bloodstream infections.