Project finance

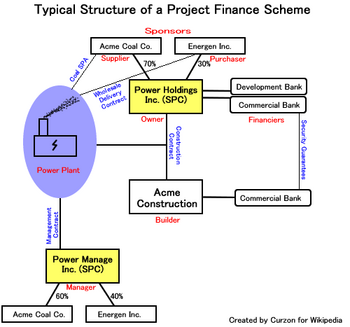

Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation.

Traditionally, project financing has been most commonly used in the extractive (mining), transportation,[2] telecommunications, and power industries, as well as for sports and entertainment venues.

A project may be subject to a number of technical, environmental, economic and political risks, particularly in developing countries and emerging markets.

"Several long-term contracts such as construction, supply, off-take and concession agreements, along with a variety of joint-ownership structures are used to align incentives and deter opportunistic behaviour by any party involved in the project.

[4] A riskier or more expensive project may require limited recourse financing secured by a surety from sponsors.

Its use in infrastructure projects dates to the development of the Panama Canal, and was widespread in the US oil and gas industry during the early 20th century.

However, project finance for high-risk infrastructure schemes originated with the development of the North Sea oil fields in the 1970s and 1980s.

Such projects were previously accomplished through utility or government bond issuances, or other traditional corporate finance structures.

The need for project financing remains high throughout the world as more countries require increasing supplies of public utilities and infrastructure.

The new project finance structures emerged primarily in response to the opportunity presented by long term power purchase contracts available from utilities and government entities.

The policy resulted in further deregulation of electric generation and, significantly, international privatization following amendments to the Public Utilities Holding Company Act in 1994.

The process can be divided into three distinct phases: A financial model is constructed by the sponsor as a tool to conduct negotiations with the investor and prepare a project appraisal report.

It is usually a spreadsheet designed to process a comprehensive list of input assumptions, and to provide outputs that reflect the anticipated "real life" interaction between data and calculated values for a particular project.

Properly designed, the financial model is capable of sensitivity analysis, i.e. calculating new outputs based on a range of data variations.

The concession agreement concedes the use of a government asset (such as a plot of land or river crossing) to the project company for a specified period.

The main creditors often enter into the Intercreditor Agreement to govern the common terms and relationships among the lenders in respect of the borrower’s obligations.

The tripartite deed sets out the circumstances in which the financiers may “step in” under the project contracts in order to remedy any default.

Tripartite deed can give rise to difficult issues for negotiation but is a critical document in project financing.

Generally the final term sheet is attached to the mandate letter and is used by the lead arrangers to syndicate the debt.

Acme Coal and Energen form an SPC (Special Purpose Corporation) called Power Holdings Inc. and divide the shares between them according to their contributions.

However project financiers may recognize this and require some sort of parent guarantee for up to negotiated amounts of operational liabilities.

The net cash flow of the SPC Power Holdings (sales proceeds less costs) will be used to repay the financiers.

In many cases, an outside insurer will issue a performance bond to guarantee timely completion of the project by the contractor.

Such projects are often governed by a capital improvement plan which adds certain auditing capabilities and restrictions to the process.

Project financing in transitional and emerging market countries are particularly risky because of cross-border issues such as political, currency and legal system risks.