Retail Price Index

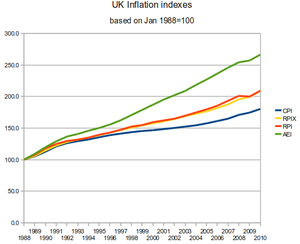

[9] Since 2003, it is no longer used by the government for the inflation target for the Bank of England's Monetary Policy Committee[10] nor, from April 2011, as the basis for the indexation of pensions of former public sector employees.

[11] As of 2016[update], the UK state pension is indexed by the highest of the increase in average earnings, CPI or 2.5% ("the triple lock").

[14] From March to October 2009, the change in RPI measured over a 12-month period was negative, indicating an overall annual reduction in prices, for the first time since 1960.

[8] In February 2011, annual RPI inflation jumped to 5.1%[16] putting pressure on the Bank of England to raise interest rates despite disappointing projected GDP growth of only 1.6% in 2011.

[19] In November 2021, inflation has risen faster than projected to its highest level in nearly a decade, putting pressure on the Bank of England to increase interest rates.

[21] The United Kingdom RPI is constructed as follows: This enables the percentage change to be calculated over the desired time period.

[22] The Office for National Statistics states that: The Consumer Prices Index including owner occupiers' housing costs (CPIH) is the most comprehensive measure of inflation.

The UK Government announced in the June 2010 budget that CPI would be used in place of RPI for uprating of some benefits with effect from April 2011.

[24] Regarding state pensions, the UK government confirmed in their autumn statement in 2011 that these would go up by the greater of the CPI, average earnings, or 2.5%.