Revenue stamps of the United States

Revenue stamps served to pay tax duties on items that came under two main categories, Proprietary and Documentary.

Proprietary stamps paid tax duties on goods like alcohol and tobacco, and were also used for various services, while Documentary stamps paid duties on legal documents, mortgage deeds, stocks and a fair number of other legal dealings.

For the first twelve years George Washington was the only subject featured on U.S. revenue stamps, when in 1875 an allegorical figure of Liberty finally appeared.

Revenue stamps were printed in many varieties and denominations and are widely sought after by collectors and historians.

[1] In August 1862, while the American Civil War was being waged, the United States (Union) government began taxing a variety of goods, services and legal dealings.

Because of the long wait involved one of the major points of contention was the appreciable amount of increase for materials between the time the agreement was made and when the bill was finally settled.

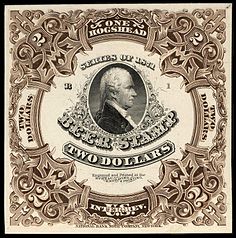

[4] The new stamps were printed in several colors and depicted a portrait of George Washington on all thirty denominations from one-cent to $200.

Three distinct revenue stamp series were produced to pay the taxes during that twenty one-year period.

[9] Several other widely used products, such as cotton, tobacco and alcohol, were also charged a proprietary tax which appreciably contributed to the revenues generated.

Denominations of 2-dollars through 10-dollars have tax duties designated in the lower circular banner surrounding Washington's portrait.

Rollins expressing the concern that "The U.S. government loses thousands of dollars daily by stamps being used a second time."

This particular suggestion however was not taken up by Butler & Carpenter, but instead, after a period of experimentation, they responded to the problem by producing stamps of a lighter shade and on a paper that more readily absorbed cancellation ink.

[14] The Internal revenue was frequently sending stamps suspected of having cancellation ink washed to the engravers and printers for inspection to determine if they had been tampered with.

[13] Still produced by Butler & Carpenter of Philadelphia, the entire second series, with the exception of the 200-dollar issue, were printed in the same bi-color combination, with the portrait of Washington printed in black and with the frame work in blue with various ornate and elaborate designs, popular during that period.

The only surviving full sheet of the small Persian rug, was used to pay tax duties on the will of Erastus Corning, Sr. in 1872.

The 500-dollar large Persian rug is indeed larger, measuring 2+1⁄8 by 4 inches with only 204 stamps of this denomination ever issued.

[16][17] Taxes were commonly levied on alcohol and tobacco products and a variety of such stamps were printed for this purpose.

[21] Quantities printed for this issue were great, totaling 228,351,689 stamps, which include both standard and rouletted perforations.

The law was to become effective on July 1, 1898, leaving only seventeen days to produce the badly needed revenue stamps.

Because of shortages of revenue stamps two shipping firms operating along the Erie Canal used the existing 1c Trans-Mississippi stamp issue which was approved by the Federal District Revenue Collector who commissioned the Purvis Printing Company to do the overprinting.

In each case five panes of 50 stamps were overprinted with the initials I.R..[24]In the continuation of providing funding for the Spanish–American War Congress authorized a tax on a wide range of goods and services including various alcohol and tobacco products, tea and other amusements and also on various legal and business transactions (such as Stock certificates, bills of lading, manifests, and marine insurance).

[25][26] There are seventeen stamps in this issue which occur in denominations ranging from ½-cent to 50-dollars which were printed on double lined watermarked paper.

As an added security measure each of these high value stamps was given its own unique serial number.

[32] During the period from 1940 to 1958 the Department of Internal Revenue released several hundred, Documentary, revenue stamps in three basic designs with denominations that ranged from 1-cent to 10,000-dollars and with a variety of different portraits of notable statesmen, each denomination of stamp bearing a different portrait.

[34] The proprietor paid the cost of engraving the die and the printing plates which in the beginning varied considerably.

A variety of patent medicines, wines and other goods like perfumery and cosmetics were taxed, but only a comparatively small number of companies used private die stamps during this period.

issued in 1862

1871 issue

1871 issue

1871 issue

1871 issue

1871 issue

1871 issue

1871 issue

1871 issue

1871 issue

issue of 1871

1871 issue

1871 issue

1871 issue

1871issue

1866 issue

1870 issue

1872 issue

1872 issue

1871 issue

1872 issue

stamp (at left) and plate proof

1898 issue

1898 issue

1895 issue

1898 issue

1898 issue

Stamps depict the image of the USS Maine

1899 issue

1899 issue

1899 issue

1917 issue

1914 issue

1914 issue

1940 issue

1940 issue

1952 issue

issued 1874

tax stamp, 10c

battleship, 10c 1898 issue.jpg