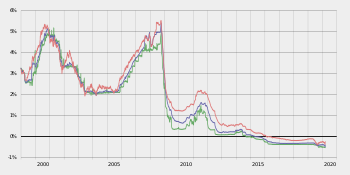

Risk-free rate

In Fisher's model, these are described by two potentially offsetting movements: The correct interpretation is that the risk-free rate could be either positive or negative and in practice the sign of the expected risk-free rate is an institutional convention – this is analogous to the argument that Tobin makes on page 17 of his book Money, Credit and Capital.

[3] In a system with endogenous money creation and where production decisions and outcomes are decentralized and potentially intractable to forecasting, this analysis provides support to the concept that the risk-free rate may not be directly observable.

In business valuation the long-term yield on the US Treasury coupon bonds is generally accepted as the risk-free rate of return.

This appears to be premised on the basis that these institutions benefit from an implicit guarantee, underpinned by the role of the monetary authorities as 'the lendor of last resort.'

(In a system with an endogenous money supply the 'monetary authorities' may be private agents as well as the central bank – refer to Graziani 'The Theory of Monetary Production'.)

Similar conclusions can be drawn from other potential benchmark rates, including AAA-rated corporate bonds of institutions deemed 'too big to fail.'

The risk-free interest rate is highly significant in the context of the general application of capital asset pricing model which is based on the modern portfolio theory.

There are numerous issues with this model, the most basic of which is the reduction of the description of utility of stock holding to the expected mean and variance of the returns of the portfolio.

[7] The risk-free rate is also a required input in financial calculations, such as the Black–Scholes formula for pricing stock options and the Sharpe ratio.