Robert J. Shiller

Writing in The Wall Street Journal in August 2006, Shiller again warned that "there is significant risk of a ... possible recession sooner than most of us expected.

[9] Eugene Fama, Lars Peter Hansen and Shiller jointly received the 2013 Nobel Memorial Prize in Economic Sciences, "for their empirical analysis of asset prices".

[14] Shiller attended Kalamazoo College for two years before transferring to the University of Michigan where he graduated Phi Beta Kappa with a B.A.

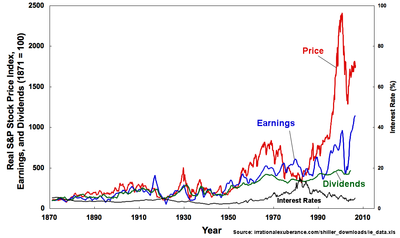

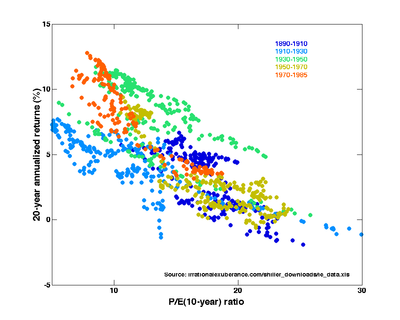

Shiller concluded that the volatility of the stock market was greater than could plausibly be explained by any rational view of the future.

Shiller's work included survey research that asked investors and stock traders what motivated them to make trades; the results further bolstered his hypothesis that these decisions are often driven by emotion instead of rational calculation.

Writing in The Wall Street Journal in August 2006, Shiller again warned that "there is significant risk of a very bad period, with slow sales, slim commissions, falling prices, rising default and foreclosures, serious trouble in financial markets, and a possible recession sooner than most of us expected.

His contributions on risk sharing, financial market volatility, bubbles and crises, have received widespread attention among academics, practitioners, and policymakers alike.

[27] In 2012, Thomson Reuters named him a contender for that year's Nobel Prize in Economics, citing his "pioneering contributions to financial market volatility and the dynamics of asset prices".

[28] On October 14, 2013, it was announced that Shiller had received the 2013 Nobel Prize in Economics alongside Eugene Fama and Lars Peter Hansen.

Also, in the lecture, Shiller pointed out that variables such as interest rates and building costs did not explain the movement of the housing market.

Additionally, he alluded to John Maynard Keynes's explanation of stock markets to point out the irrationality of people while making decisions.

Therefore, he believes that people do not use complicated mathematical calculations and a sophisticated economic model while participating in the asset market.

Since there were very minuscule data available on the asset markets for his research, let alone for the common people, he developed the Case-Shiller index that provides information about the trends in home prices.

Thus, he added that the use of modern technology can benefit economists to accrue data of broader asset classes that will make the market more information-based and the prices more efficient.

[33] The perceived failure of the Cincinnati Time Store has been used as an analogy to suggest that cryptocurrencies like Bitcoin are a "speculative bubble" waiting to burst, according to economist Robert J.