RuPay

It was launched in 2012, to fulfil the Reserve Bank of India's (RBI) vision of establishing a domestic, open and multilateral system of payments.

It arose from the absence of a domestic price setter, which caused Indian banks to bear high costs for affiliation and connection with international payment systems like Visa and Mastercard.

[23] Under its Payments Vision 2025, RBI aimed to further push for the internationalization of RuPay, with countries using the United States dollar, Pound sterling and Euro under bilateral treaties.

[24][25] NIPL signed a definitive agreement with PPRO Financial on 27 April 2023 that will enable acceptance of UPI among international payment service providers (PSPs) and global merchant acquirers.

Under Rupay Select, all benefits are curated under one package, independent of bank partnerships, saving customers the hassle of applying for multiple card schemes.

RuPay Select allows NPCI to capture a share of the high-spending customer market and provide an Indian alternative against premium offerings from Mastercard, Visa etc.

[55] NPCI, in collaboration with Kotak Mahindra Bank, launched specially designed RuPay credit cards for the Indian Armed Forces on 28 October 2021.

[56][57] BOB Financial and NPCI partnered to launch Bank of Baroda RuPay and JCB co-branded international credit card on 16 November 2021.

[70] RBL Bank partnered with GI Technology, a Wirecard subsidiary and India's largest wallet-based domestic money remittance company operating under the brand name ICashCard to launch RBL-ICASH co-branded, open loop RuPay Prepaid Card.

[71] ItzCash, India's largest digital payments company, announced that it has partnered with RBL Bank to launch the country's first co-branded Rupay Platinum Prepaid Card.

The card will offer special cashback programmes for POS transactions outside India, in addition to selected popular international destinations for travellers.

[84] NPCI launched the RuPay Commercial Credit Card for corporate clients on 23 July 2020 at Global Fintech Fest in partnership with State Bank of Mauritius (SBM).

Fintech startup Yap helped in developing the application programming interface (API) powering the card while EnKash will provide dedicated customer support and expense management service.

[87] RuPay Pro credit card is also launched on 23 July 2020 at Global Fintech Fest but is mainly oriented towards young individual entrepreneurs.

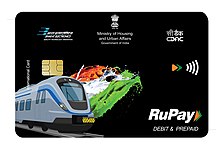

It also launched similar prepaid contactless cards for the Kochi Metro Rail Ltd (KMRL) and Bangalore Metropolitan Transport Corporation (BMTC) in association with Axis Bank.

The card uses Near Field Communication (NFC) technology and can be used by the railway travellers for benefits on retail, dining and entertainment besides transaction fee waivers.

[98] NPCI on the eve of Global Fintech Festival 2021 launched RuPay On-the-Go interoperable, open-loop contactless solution that are made available on smartwatch and other personal electronic accessories eliminating the need to carry physical card.

Users can pay at a variety of retail sites and public transportation hubs, including as bus stops, metro stations, and parking lots.

This will help share unique token reference ID number instead of actual card details between customers, merchants and banks for transactions and stop identity theft and hacks.

[104] This is developed by NPCI in collaboration with Mastercard, and Visa as an integrated interoperable QR code based payment system and was launched in September 2016.

[119] Reserve Bank of India (RBI) and Royal Monetary Authority of Bhutan (RMA) announced that they would integrate the financial switches of the two countries in order to simplify cross border transactions.

[121][122] Prime Minister Narendra Modi announced that RuPay cards would be launched in the Maldives during his address to the People's Majlis (the Maldivan Parliament) on 8 June 2019.

[129] An MoU on 25 August 2019 was signed between The Benefit Company for handling ATM and POS transactions among others, and National Payments Corporation of India (NPCI) for launch of RuPay card in the Gulf Kingdom.

[130] As of 2021, BENEFIT is enabling its member acquirers of 515 ATMs and 40,000 PoS terminals in Bahrain to accept and recognize Issuer Identification Numbers (IIN) from NPCI International Payment Limited (NIPL).

[132] During a meeting with Majid bin Abdullah Al Qasabi on 19 September 2022, Commerce and Industry Minister Piyush Goyal discussed introduction of RuPay in the country.

[134] BC Card announced on 23 August 2017 that it has signed a bilateral memorandum of understanding (MoU) for strategic network partnership with National Payments Corporation of India (NPCI).

[149] Under the aegis of the Government of India, NPCI started discussion on infrastructure development for digital payment, financial inclusion and Direct Benefit Transfer.

[21] RuPay was appointed as an official partner of the Indian Premier League by the Board of Control for Cricket in India in a multi-year partnership beginning from the 2022 season.

[168][169][170] Kotak Mahindra Bank, in partnership with RuPay, rolled out an initiative for financial inclusion, where the dairy farmers across 75 cooperative societies of Amul in regions of Burdwan and Hooghly of West Bengal will be able to get their payments directly into their accounts on the same day as the sale of their milk.

[171] The same model is planned to be adopted in the state of Gujarat where 1,200 cooperative societies comprising over 3 lakh dairy farmers will be the part of the programme.