Russia in the European energy sector

It established sale subsidiaries in many of its export markets, and also invested in access to industrial and power generation sectors in Western and Central Europe.

In addition, Gazprom established joint ventures to build natural gas pipelines and storage depots in a number of European countries.

Gazprom intends to decommission some pipelines, over forty years old with high maintenance costs, in the central corridor as NPT production declines.

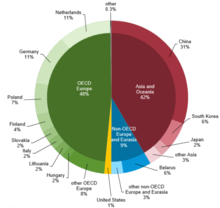

Other larger Russian gas importers in the European Union are France, Hungary, the Czech Republic, Poland, Austria and Slovakia.

[24] In response to Russian military buildup and recognition of Ukrainian separatists, Germany cancelled opening of the Nord Stream 2 in February 2022.

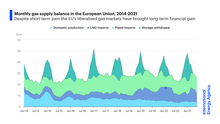

Natural gas consumption in the EU and UK overall remained broadly flat in over this period, but production fell by a third and the gap has been filled by increased imports.

Russia completed work on the Nord Stream II pipeline in 2021, but the German government decided not to approve certification in the wake of the Russian invasion of Ukraine.

The Economist Intelligence Unit reported that Russia had limited extra gas export capacity because of high domestic requirements with production near its peak, as well as technical issues.

[33][34] The Russian state-owned Gazprom reduced its piped gas supplies to the EU market by 25% in the fourth quarter of 2021 compared to the same period in 2020.

[31] Other pipeline suppliers, including Algeria, Azerbaijan and Norway, increased their deliveries during the heating season to the European market compared with last year, using commercially available supply routes.

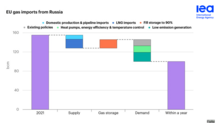

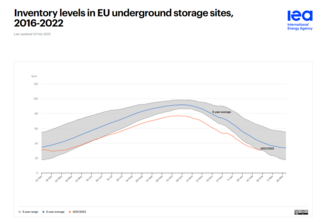

Without the strong increase in LNG imports since October 2021, European storage levels would have been less than 15% full by February 2022 (vs 31% in reality), leaving Europe in a much more vulnerable position vis-à-vis late cold spells or supply disruptions.

[31] For context, expert analysis suggests that fill levels of at least 90% of working storage capacity by 1 October are necessary to provide an adequate buffer for the European gas market through the winter heating season.

These reduced Russian pipeline flows, together with low storage levels and adverse weather conditions, contributed to strong upward pressure on prices in Europe, which averaged more than US$30 per million British thermal units (BTU) in the fourth quarter of 2021.

Unseasonably mild weather conditions led to a slight decrease in demand (declining by 14% year-on-year according to preliminary estimates), and a 20% increase in wind energy output in the first quarter of 2022 reduced gas burn in the power sector.

In late August, Gazprom gradually stopped delivering gas through the Nord Stream 1 pipeline as well, citing a leak and technical issues due to the European sanctions on Russia.

"[46] After that, the variety of national policies and stances of larger exporters versus larger dependents of Russian natural gas, together with the segmentation of the European natural gas market, became a prominent issue in European politics toward Russia, with significant geopolitical implications for economic and political ties between the EU and Russia.

[47] A number of disputes over the natural gas prices in which Russia was using pipeline shutdowns in what was described as "tool for intimidation and blackmail"[48] caused the European Union to significantly increase efforts to diversify its energy sources.

[49] Part of the aim of the Energy Union is to diversify the EU’s gas supplies away from Russia, which has already proved to be an unreliable partner, first in 2006 and then in 2009, and which threatened to become one again at the outbreak of the conflict in Ukraine in 2013–2014.The Nord Stream 2 gas pipeline from Russia to Germany was opposed by former Ukrainian President Petro Poroshenko, Polish Prime Minister Mateusz Morawiecki, former U.S. President Donald Trump and then British Foreign Secretary and later prime minister Boris Johnson.

[50][51] The United States has been encouraging European countries to diversify Russian-dominated energy supplies, with Qatar as possible alternative supplier.

[52] To compare with alternative sources, Germany produced 10.5% of its electricity from natural gas in 2019 and 8.6% (44 TWh) from renewable biomass, largely biogas.

[56] In August 2021 Russia reduced volumes of gas sent to European Union,[57][58] which was seen by some analysts and politicians as an attempt to "support its case in starting flows via Nord Stream 2".

[33] In October 2021, the Economist Intelligence Unit reported that Russia had limited extra gas export capacity because of high domestic requirements with production near its peak.

[24] In September 2021 Russia announced that "rapid" start up of the newly completed Nord Stream 2 pipeline that had long been contested by various EU countries would resolve the problems.

[82] In May 2022, the European Commission proposed a ban on oil imports from Russia, part of the economic response to the 2022 Russian invasion of Ukraine.

[86] French Finance Minister Bruno Le Maire said that France negotiated with the United Arab Emirates to replace some Russian oil imports.

[91] Due to the increasing scarcity and cost of fossil resources, Europe has been purchasing oil and liquefied gas from all over the world at any price.

"[96] On 2 September 2022, the G7 group of nations agreed to cap the price of Russian oil in order to reduce Russia's ability to finance its war with Ukraine without further increasing inflation.

[108] The Baltic Pipe between Norway and Poland will have the capacity to replace the roughly 60% of Polish gas imports coming from Russia via the Yamal pipeline, and is expected to be operational by the end of 2022.

In spite of these efforts, Ukraine secured a number of framework contracts with numerous suppliers, eventually supplying 50% of the fuel from Russia and 50% from Sweden.

Text taken from Europe and the world needs to draw the right lessons from today's natural gas crisis, Fatih Birol, the International Energy Agency.