Shanghai Stock Exchange

[4] Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors and often affected by the decisions of the central government[5] due to capital account controls exercised by the Chinese mainland authorities.

The first shares list appeared in June 1866 and by then Shanghai's International Settlement had developed the conditions conducive to the emergence of a share market: several banks, a legal framework for joint-stock companies, and an interest in diversification among the established trading houses (although the trading houses themselves remained partnerships).

In 1904, the Association applied for registration in Hong Kong under the provision of the Companies ordinance and was renamed as the "Shanghai Stock Exchange".

An amalgamation eventually took place in 1929, and the combined markets operated thereafter as the "Shanghai Stock Exchange".

By the 1930s, Shanghai had emerged as the financial center of the Far East, where both Chinese and foreign investors could trade stocks, debentures, government bonds, and futures.

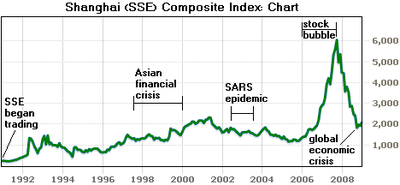

In 1946, the Shanghai Stock Exchange resumed its operations before closing again 3 years later in 1949, after the Communist revolution took place.

After the Cultural Revolution ended and Deng Xiaoping rose to power, China was re-opened to the outside world in 1978.

On 26 November 1990, the Shanghai Stock Exchange was re-established and operations began a few weeks later on 19 December.

[8]: 102 In 2019, the Shanghai Stock Exchange launched the STAR Market, featuring only technology-related companies, as a rival to the NASDAQ.

Currently, a total of 98 foreign institutional investors have been approved to buy and sell A shares under the QFII program.

According to the regulations of Securities Law of the People's Republic of China and Company Law of the People's Republic of China, limited companies applying for the listing of shares must meet the following criteria: Other conditions stipulated by the State Council.

The conditions for applications for the listing of shares by limited companies involved in high and new technology are set out separately by the State Council.