Candlestick pattern

[3][4] Some of the earliest technical trading analysis was used to track prices of rice in the 18th century.

He was a Japanese rice trader who tracked price action and saw patterns developing.

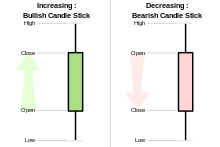

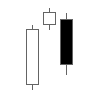

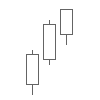

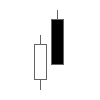

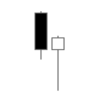

Stock price prediction based on K-line patterns is the essence of candlestick technical analysis.

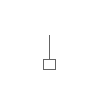

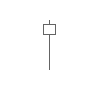

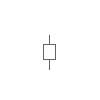

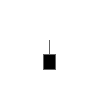

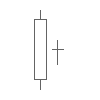

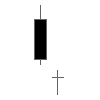

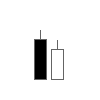

They are commonly formed by the opening, high, low, and closing prices of a financial instrument.

The lines above and below, known as shadows, tails, or wicks, represent the high and low price ranges within a specified time period.