Sixteenth Amendment to the United States Constitution

It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers' Loan & Trust Co.

The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in Pollock.

During the late nineteenth century, various groups, including the Populist Party, favored the establishment of a progressive income tax at the federal level.

[3] During the War of 1812, Secretary of the Treasury Alexander J. Dallas made the first public proposal for an income tax, but it was never implemented.

The Civil War income taxes, which expired in 1872, proved to be both highly lucrative and drawing mostly from the more industrialized states, with New York, Pennsylvania, and Massachusetts generating about 60 percent of the total revenue that was collected.

[12][13] In 1894, an amendment was attached to the Wilson–Gorman Tariff Act that attempted to impose a federal tax of two percent on incomes over $4,000 (equal to $141,000 in 2023).

[18]Members of Congress responded to Pollock by expressing widespread concern that many of the wealthiest Americans had consolidated too much economic power.

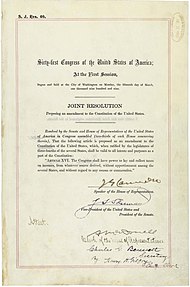

[25] On July 12, 1909, the resolution proposing the Sixteenth Amendment was passed by the Congress[26] and was submitted to the state legislatures.

From well before 1894, Democrats, Progressives, Populists and other left-oriented parties argued that tariffs disproportionately affected the poor, interfered with prices, were unpredictable, and were an intrinsically limited source of revenue.

The South and the West tended to support income taxes because their residents were generally less prosperous, more agricultural and more sensitive to fluctuations in commodity prices.

A sharp rise in the cost of living between 1897 and 1913 greatly increased support for the idea of income taxes, including in the urban Northeast.

[29] These Republicans were driven mainly by a fear of the increasingly large and sophisticated military forces of Japan, Britain and the European powers, their own imperial ambitions, and the perceived need to defend American merchant ships.

[30] Moreover, these progressive Republicans were convinced that central governments could play a positive role in national economies.

Opposition to the Sixteenth Amendment was led by establishment Republicans because of their close ties to wealthy industrialists, although not even they were uniformly opposed to the general idea of a permanent income tax.

In 1910, New York Governor Charles Evans Hughes, shortly before becoming a Supreme Court Justice, spoke out against the income tax amendment.

[35] The Revenue Act of 1913, which greatly lowered tariffs and implemented a federal income tax, was enacted shortly after the Sixteenth Amendment was ratified.

[40][41] Professor Sheldon D. Pollack at the University of Delaware wrote: On February 25, 1913, in the closing days of the Taft administration, Secretary of State Philander C. Knox, a former Republican senator from Pennsylvania and attorney general under McKinley and Roosevelt, certified that the amendment had been properly ratified by the requisite number of state legislatures.

Notwithstanding the many frivolous claims repeatedly advanced by so-called tax protestors, the Sixteenth Amendment to the Constitution was duly ratified as of February 3, 1913.

Congress once again had the "power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration".

Subsequent cases have viewed the Sixteenth Amendment as a rejection of Pollock's definition of "direct tax".

Even if the Sixteenth Amendment is not viewed as narrowing the definition of direct taxes, it at least introduces an additional consideration to analysis under the Apportionment Clause.

In Bowers v. Kerbaugh-Empire Co., 271 U.S. 170 (1926), the Supreme Court, through Justice Pierce Butler, stated: It was not the purpose or the effect of that amendment to bring any new subject within the taxing power.

[citations omitted] After full consideration, this court declared that income may be defined as gain derived from capital, from labor, or from both combined, including profit gained through sale or conversion of capital.In Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955), the Supreme Court laid out what has become the modern understanding of what constitutes "gross income" to which the Sixteenth Amendment applies, declaring that income taxes could be levied on "accessions to wealth, clearly realized, and over which the taxpayers have complete dominion".

Under this definition, any increase in wealth—whether through wages, benefits, bonuses, sale of stock or other property at a profit, bets won, lucky finds, awards of punitive damages in a lawsuit, qui tam actions—are all within the definition of income, unless the Congress makes a specific exemption, as it has for items such as life insurance proceeds received by reason of the death of the insured party,[56] gifts, bequests, devises and inheritances,[57] and certain scholarships.

[58] Federal courts have ruled that the Sixteenth Amendment allows a direct tax on "wages, salaries, commissions, etc.

Congress has the power to impose taxes generally, and if the particular imposition does not run afoul of any constitutional restrictions then the tax is lawful, call it what you will.On December 22, 2006, a three-judge panel of the United States Court of Appeals for the District of Columbia Circuit vacated[62] its unanimous decision (of August 2006) in Murphy v. Internal Revenue Service and United States.

[63] In an unrelated matter, the court had also granted the government's motion to dismiss Murphy's suit against the Internal Revenue Service.

On July 3, 2007, the Court (through the original three-judge panel) ruled (1) that the taxpayer's compensation was received on account of a nonphysical injury or sickness; (2) that gross income under section 61 of the Internal Revenue Code[65] does include compensatory damages for nonphysical injuries, even if the award is not an "accession to wealth", (3) that the income tax imposed on an award for nonphysical injuries is an indirect tax, regardless of whether the recovery is restoration of "human capital", and therefore the tax does not violate the constitutional requirement of Article I, Section 9, Clause 4, that capitations or other direct taxes must be laid among the states only in proportion to the population; (4) that the income tax imposed on an award for nonphysical injuries does not violate the constitutional requirement of Article I, Section 8, Clause 1, that all duties, imposts and excises be uniform throughout the United States; (5) that under the doctrine of sovereign immunity, the Internal Revenue Service may not be sued in its own name.