Social insurance

The World Bank's 2019 World Development Report on The Changing Nature of Work[5] considers the appropriateness of traditional social insurance models that are based on steady wage employment in light of persistently large informal sectors in developing countries and the decline in standard employer-employee relationships in advanced countries.

If what individuals receive is proportional to their contributions, social insurance can be considered a government "production activity" rather than redistribution.

Given that what some receive is far higher than what they attribute (on an actuarial basis), there is a large element of redistribution involved in government social insurance programs.

Social insurance is based on the premise that there is not always equitable distribution of resources or benefits in a competitive economy and there must be provisions to ensure that participants in the market do not end up with an "all-or-nothing-game".

[7] It is a means to allow participants of a dynamic economy to take risks and engage in economic activity with the assurance that in the instance of an emergency, they will be protected through this accumulated fund.

Ultimately the insurance company is losing money since they cannot discriminate between buyers and thus they further increase prices.

In the case of the Affordable Care Act, for example, an individual mandate was included which required Americans to purchase health insurance or be subject to a financial penalty.

This allowed higher cost individuals, from the perspective of insurance companies, such as people with pre-existing conditions to be covered and not excluded at a reasonable rate.

If individuals do not have social insurance and are thereby unable to afford the basic right of healthcare, then not only are they subjecting themselves to illnesses but also creating the likelihood that others around them will be infected as well.

[13] Moral hazard has important implications for optimal social insurance programs, particularly in the case of unemployment benefits: the presence of moral hazard entails that, paradoxical as it may seem, individuals should optimally be only partially insured against unemployment.

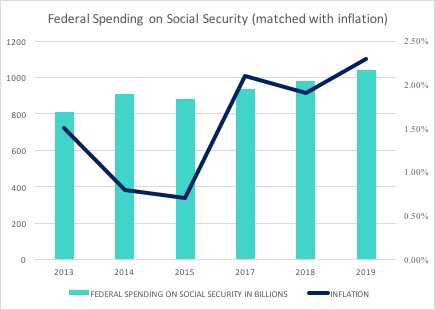

"The increase in payroll tax receipts reflects higher wages and salaries and the reallocations made between payroll and individual income taxes"[15] Unemployment insurance and workers' compensation are essential aspects of Social Insurance that indeed provide unparalleled assistance to citizens facing uncertainty regarding their jobs.

In the US, there are welfare-to-work programs that give unemployed people an incentive to work if they are starting to seek a job.