Spanish property bubble

[10] Alcidi and Gros note; “If construction were to continue at the still relatively high rate of today, the process of absorption of the bubble would take more than 30 years”.

On their behalf, the sectors in disagreement with the economic situation, more connected to the consumers, mainly affected by the increase of prices and the difficulties of access to housing, insisted in valuing the same data in the opposite sense, the same that other groups framed as a social critique and the Green Movement.

On the other hand, the lack of transparency that characterizes the housing market in Spain impeded making exact evaluations of the situation: while one entity sent calm and alarming messages at the same time, the statistics never were systematic and were characterized by dispersion, when they were not simply contradictory, but remaining part of the hidden tax real estate market, upon moving in part with black money or in a form of corruption.

In that sense, some specialists denounced even a campaign of a lack of transparency and secrecy of the means of communication that, based in economic interests, would have avoided mentioning the true nature of the boom in housing costs.

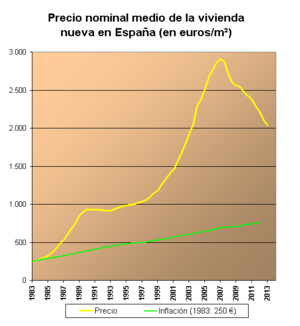

In any case, in the first months of 2008 the strong deceleration of the Spanish housing market already permitted some economists like Alan Greenspan, the former chair of the Federal Reserve, to talk about a speculative bubble and its burst.

In 2009, still nobody had doubted that an enormous speculative real estate bubble had exploded around the world, with particular virulence in Spain, which as a result saw an immersive deep economic recession.

Also, it speculated success when the bubble exploded and the financial situation intensified, the government that would have been in power would have summoned early elections.

The same Bank of Spain rejected the idea that would have revolved around a speculative bubble:The results of the work carried out in the housing market did not support, according to the Bank of Spain, the hypothesis of equilibrium or a bubble, but rather reinforced the confusion that the situation of the Spanish real estate market was characterized at the end of 2004 by an over-valuation of suitable housing with a gradual uptake of the found discrepancy among the observed prices and the explained prices by its fundamental in the long term.

[12]However, the official reports of that entity also recognized the over-valuation of real estate assets, and already in the year 2002 alerted about a possible depreciation of housing.

On the other extreme were the critiques of those who estimated that things were occurring before a real estate bubble of unpredictable consequences:A colossal speculative [real estate] bubble has been developing for many years already, which has been characterized by the Economist (June 18, 2005) as a major speculative process in the history of capitalism.In general, from the critical positions it was affirmed that the dependence of the Spanish economy on the construction industry, as well as excessive debt, could have provoked an economic recession in the long term, especially with the rise in interest rates, that eroded domestic consumption and raised the unemployment rate and the default levels, finally leading to a devaluation of real estate assets.

[25] In fact, the Bank of Spain has warned each year about the high rates of indebtedness of Spanish households,[26] which according to the institution was unsustainable.

[28] The President of the Chambers of Commerce of Spain, Javier Gómez Navarro, said at an event organized by the Association of Financial Journalists, entities "never recover" 30% of the debt owed to the housing sector.

de Acuna & Asociados, a real-estate consulting firm, more than half of the country’s 67,000 developers can be categorized as “zombies”, having liabilities that exceed their assets and only enough income to repay the interest on their loans.