Supporting organization (charity)

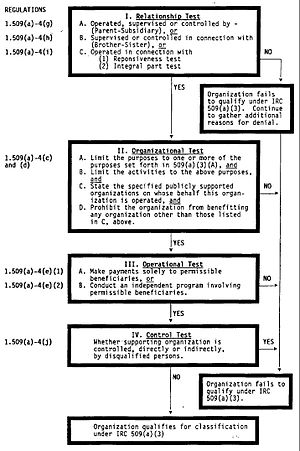

A supporting organization, in the United States, is a public charity that operates under the U.S. Internal Revenue Code in 26 USCA 509(a)(3).

A supporting organization either makes grants to, or performs the operations of, a public charity similar to a private foundation.

[3] Mostly large and medium-sized donors created supporting organizations in order to retain some control over their donated assets.

As a consequence, supporting organizations (particularly Type III) proved attractive to high and middle-high value donors with anecdotal evidence of their widespread abuse.

Senators Baucus and Grassley argued that supporting organizations, particularly Type III, allowed donors to retain too much control over their assets.

[7] Another perceived abuse related to liberal charitable deductions allowed to donors who contribute to supporting organizations.

Further restrictions, including explication of the payout rate contours will result from the Congress mandated survey that the IRS promulgated.

[22] This type III relationship,[20] however, recently has received a crackdown by Congress and so its flexibility and relaxed standards for control and scrutiny is short-lived.

Is not controlled directly or indirectly by one or more disqualified persons (as defined in 26 USCA 4946) other than foundation managers and other than one or more organizations described in paragraph 509(a)(1) or (2)This requirement provides prophylactic protection against self-dealing, a potential abuse.

Currently, the IRS has halted determinations on all requests by organizations for FISO classification until the US Treasury Department issues guidance on this matter.

[28] A supporting organization in combination with its disqualified persons may not own more than 20% of voting stock in a business entity not related to the furtherance of its charitable purpose.

[31] The regulations may change as the IRS has suspended determinations of what constitutes a functionally integrated type III supporting organization until such time that the Treasury Department may issue further guidance.